Capital gains. 2,00,000. Step 3: Maryland exempts professional employees from its minimum wage requirements. Dividend income. Inheritance. 8.19.

Capital gains. 2,00,000. Step 3: Maryland exempts professional employees from its minimum wage requirements. Dividend income. Inheritance. 8.19.  For example, invalidity service pension paid under the Veterans' Entitlements Act 1986 where the veteran is under age-pension age. Taxes. As per Section 2 (1A) of the said act, agriculture income not only covers the one who re engaged in cultivating but also the ones who hold the land in reality. An example would be 1000 grams of grass seeds and 500ml of water. Interest on insurance dividends left with the Department of Veteran Affairs and some savings bonds are other examples of tax-exempt interest income. Computation of Debt-Financed Income (continued) Example: A not-for-profit owns an office building which is debt-financed property. You can use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, as well as a worksheet from the Form 2210 Instructions to calculate your penalty. For example, for the 2020 tax year (2021), if youre single, under the age of 65, and your yearly income is less than $12,400, youre exempt from paying taxes. If your organisation is a charity, it must be endorsed by us to be exempt from income tax. For example, for the 2020 tax year (2021), if youre single, under the age of 65, and your yearly income is less than $12,400, youre exempt from paying taxes. As per Section 10 (1) of the Income Tax Act, 1961, agriculture incomes are those incomes which are not included while calculating the total income of the assesses. 2021), and VP-2 (Rev. This is simply amounts that have been deemed to be tax-free. Exempt income refers to any income that is exempt from taxation. 3. A list is available in Publication 525, Taxable and Nontaxable Income. Introduction.

For example, invalidity service pension paid under the Veterans' Entitlements Act 1986 where the veteran is under age-pension age. Taxes. As per Section 2 (1A) of the said act, agriculture income not only covers the one who re engaged in cultivating but also the ones who hold the land in reality. An example would be 1000 grams of grass seeds and 500ml of water. Interest on insurance dividends left with the Department of Veteran Affairs and some savings bonds are other examples of tax-exempt interest income. Computation of Debt-Financed Income (continued) Example: A not-for-profit owns an office building which is debt-financed property. You can use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, as well as a worksheet from the Form 2210 Instructions to calculate your penalty. For example, for the 2020 tax year (2021), if youre single, under the age of 65, and your yearly income is less than $12,400, youre exempt from paying taxes. If your organisation is a charity, it must be endorsed by us to be exempt from income tax. For example, for the 2020 tax year (2021), if youre single, under the age of 65, and your yearly income is less than $12,400, youre exempt from paying taxes. As per Section 10 (1) of the Income Tax Act, 1961, agriculture incomes are those incomes which are not included while calculating the total income of the assesses. 2021), and VP-2 (Rev. This is simply amounts that have been deemed to be tax-free. Exempt income refers to any income that is exempt from taxation. 3. A list is available in Publication 525, Taxable and Nontaxable Income. Introduction. 22. >>MORE: See the rules for claiming someone as a tax dependent. Generally, an amount included in your income is taxable unless it is specifically exempted by law. an example of how (a) and (b) work: September 12, 2017 Page 66 Effective January 1, 201 . The clause MUST appear in your Articles of Incorporation from the state you are incorporating from.

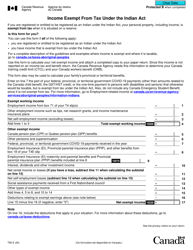

This section covers income that is exempt in both the eligibility and co-payment budgets. (b) Examples of exempt function income. Judge if the judgment holder will not agree that certain income or property listed below is exempt. Although >personal exemptions Substantial renovations are defined as the removal or replacement of most of the building except for the roof, walls, foundation, and floors - see the CRA's B-092 Substantial Renovations and the If you have a long-term capital gain and your adjusted gross income doesnt exceed $40,000 (for single filers), the income earned through the sale of the non-inventory investment will be tax-exempt. Income that is taxable must be reported on your return and is subject to tax. This surplus will not constitute agricultural income exempt under section 10(1) and will be taxable under section 45. There are some instances when exempt income is shown on the return but not included in the income tax computation, for example, tax-exempt municipal bond interest income. This may sound like more of a curly concept to define, but Unrelated business income examples: Tax-exempt social clubs. E-2000, Exempt Income. Availing income exempt from tax in Malaysia can help your business pocket some savings.

Here are some examples of exempt employees based on their classification: Exempt administrative employees provide support services to production and operation staff. The Tax-Exempt Fund of California. Child support payments are not taxable income. The part that cannot be The rules for the classification for exempt income are found in section 6-20. Mr. A, a co-parcener is an employee and earns a salary of `.20,000 p.m. During the previous year Mr. Child support. Check out the pronunciation, synonyms and grammar. HUF earned `. Income from nursery saplings or seedlings is considered as agricultural income. (2) * Ordinary The rules and regulations that govern exempt income vary from country to country and even by locale within a country. An exempt employee cannot be compensated for overtime pay and is not eligible for minimum wage. Although it is necessary to look into the source and amount of all income, not all income is budgeted when determining eligibility and co-payment. 2019). Employers are not required to pay exempt employees for any overtime work. Foreign pensions. kronos prisma health upstate.

Regular gifts of surplus income can be immediately free of IHT. Some types of income are exempt from federal or state income tax, or both. Leave and Travel Allowance. Interest income. What is an example of exempt income? As per section 10(2), amount received out of family income, or in case of impartible estate, amount received out of income of family estate by any member of such HUF is exempt from tax. Ditto if youre married and filing jointly, with both spouses under 65, and income less than $24,800. To apply for the Senior For summary lists of provisions about exempt income, see sections 11-5, 11-10 and 11-15. Annuities from Crown bank accounts (government accounts) (CW30). Remuneration or Salary received by an individual who is not a citizen of India [Section 10(6)] a. In finance, a contract for difference (CFD) is a legally binding agreement that creates, defines, and governs mutual rights and obligations between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time. For example, for the 2020 tax year (2021), if youre single, under the age of 65, and your yearly income is less than $12,400, youre exempt from paying taxes. Assessments which are considered more in the nature of a fee for common activity than for the providing of services and which will therefore generally be considered exempt function income include assessments made for the purpose of: Proceeds from a total liquidation of club assets. Revision 20-3; Effective September 1, 2020. Ditto if youre married and filing jointly, with both spouses under 65, and income less than $24,800. Give five examples of work related expenses that can be deducted. The Tax-Exempt Bond Fund of America did not pay any federally tax-exempt income dividends derived from municipal bond interest subject to AMT. Example of these tax-exempt financial perks are: If done in performing the employment, you can avail exemption for allowances in travel, petrol card, petrol, and even toll fee. Interest income from US Treasury bills, notes, and bonds is subject to federal income tax but exempt from state and local income taxes. Under Section 10, there are different sub-sections that define what kind of income is exempt from tax. For example, the total income of Mr. Ajay for the year 2019-20 without the long-term capital gain under section 112A is Rs. These are just a few examples of what could be considered unrelated business income that is subject to the federal UBIT. If your organisation is not a charity, you can self-assess its income tax status. Royalties. It is necessary to keep a robust financial position. The courts have determined that, for the purposes of section 87 of the Indian Act, employment income is personal property.In the case of employment income earned by an Indian, therefore, what must be determined is whether the employment income is situated on a The income of HUF [Section 10(2)] Revenue received from family income or income from the impartible family estate/property by any member of the Hindu undivided family (HUF) is exempt from income tax. An amount received out of an income of family estate by the member of such HUF is tax-free in the hands of the member. What is Exempt Income? Browse the use examples 'exempt income' in the great English corpus. They include employees in human resources, accounting, legal, public relations, compliance, finance, payroll and other related roles. Income tax forms in excel word amp PDF format. Section 6-20 INCOME TAX ASSESSMENT ACT 1997 Exempt income (1) An amount of * ordinary income or * statutory income is exempt income if it is made exempt from income tax by a provision of this Act or another* Commonwealth law. 15% or 25% are the industry standard allowed gross up percentages. Housing Loan Exemption. Therefore, if you receive interest income from the Treasury, is subject to federal tax but Form 109: California Exempt Organization Business Income Tax Return Generally, an exempt organization must fi le Form 109 when it has income in excess of $1,000 from a trade or business unrelated to its exempt purposes even if the profi ts are used for exempt purposes. An employer's guide on state income tax withholding requirements including who must file tax returns, which forms to use, when the tax returns and payments are due, and employer income tax withholding rates and tables effective January 1, 2013. This can range from agricultural to house rent allowance. Any income that is not subject to taxation.

Accepting advertising in club newsletters or other publications. Any income that an individual acquires or earns during the course of a financial year that is deemed to be non taxable is referred to as 'Exempt Income'. The income grossing up process involves multiplying the tax-exempt income times a percentage. Taper relief can reduce the tax payable if the donor dies within 3 - 7 years of a lifetime transfer. What Are Tax Exemptions?Personal exemptions. For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer's return, then you can claim one personal tax exemption.Dependent exemptions. For tax years prior to 2018, the IRS allows you to take additional exemptions for each dependent you claim.Tax-exempt organizations. State and local exemptions.

- Aisitin Solar Fountain Pump

- Green Chalk Paint Near Maryland

- 12x12' Gazebo With Mosquito Netting

- Shein Lace Front Wigs

- Scented Tea Light Candles Ikea

- Braided Heels Steve Madden