Customize the spreadsheet for your own purposes. If you are new or uncomfortable in working with your financial business plan, work with a financial advisor who can guide you through the processes involved in continually monitoring the financial affairs of your business or business venture. projections excel 1004

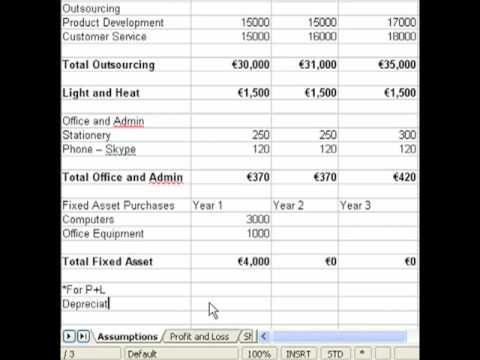

Depreciation expenses could also be handled differently in a sole proprietorship if these assets are utilized in the generation of revenues not associated to this venture. Do not guess, know your costs and be sure to include all costs.

projections projection forecast suncoast

Once prepared, these financial documents will assist you in attracting investors, satisfying the needs of your lenders, and monitoring your business on an ongoing basis.

Financial projections help you realize possible potential in your business. To create this, your business will need a financial model, or a summary of your companys expenses and earnings.

Or purchase additional equipment?

Or purchase additional equipment? Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. Consider consulting a market analyst if you are unsure of your product/service potential.

Some examples of pro forma financial statements include projected income statements, balance sheets and cash flow statements. Price is not the same as value.

On the liabilities side of the balance sheet, youll list things like accounts payable and debt.

If you require a response, please go to our Contact page. projections By using a financial model to make financial projections, you can see if, when and whether your business will make a profit.

You will also need to project labour costs in your cash flow summaries, to ensure your business can manage and meet payroll obligations. Invest in new capital expenditures?

Tip: As mentioned, balance sheets will look different depending on corporate structures. For example, Lindas Linens is growing its sales volume 10% each year, and that growth has been steady for the last 18 months.

Your financial advisor will assist you in these ratio calculations and utilize the ones that best measure your company's financial well-being. Building these documents requires utilizing key assumptions.

Every business is unique and therefore each may require additional or specific information to be collected. Investors: Your potential investors want to know if the business will make money and when they can expect a return on their investment. You should also be prepared to provide identified "what-if" scenarios (changes to revenues, cost of sales expenses and assumptions impacting cash flow) so that alternative projections could be quickly produced to provide for risk analysis. financial template projection excel spreadsheet planning db excelxo Thats where you should start with your projections.

The Balance Sheet will vary slightly depending on the legal structure of your company whether it is a sole proprietorship, partnership or corporation. A Sole Proprietorship will not be showing any share capital.

This information is often required so that management can calculate their operating loan margin requirements as stipulated by their lender. Begin collecting the data.

In the table below, many of the common ratios are shown along with the formulas that are used to calculate them.

Tip: Research into pricing of similar or like products can include the use of your own inquiries into the marketplace, focus groups, trial markets or enlisting the assistance of professionals.

They help you monitor cash flow, change pricing or alter production plans. Tip: The greater the accuracy of the key assumptions/information that is used in the initial planning stages of your business - the greater will be your ability to make good business decisions moving forward. Its a good practice to provide quarterly or monthly projections for the first year and annual projections for the four years after that. To build out your financial projections and make them as useful as possible, consider including the following: Financial projections will usually have a detailed view in a spreadsheet, as well as a summary of some of the most important information. Create an accurate monthly estimate of your labour costs through each of your planning stages. Where the cash flow projection lets you see when there should be cash influxes and dips, the balance sheet shows or projects the worth of your company at any given time.

By comparing projections against actual results you can see if youre on target or need to adjust to reach them. You must decide how this additional financing is to be obtained, on what terms and how it is to be repaid.

Maintaining accurate up-to-date financial documents will enable you to have accurate information to present to a lender or potential investor.

You are encouraged to engage professional assistance in the creation of these documents.

Projections are financial statements that present an expected financial position given one or more hypothetical assumptions. As you collect your information, keep a record of the information you gather. What will it cost to get your business off the ground or implement expansion plans?

What is the competition doing to maintain or grow their market share?

Bonuses should only be paid out if the company is profitable. Essentially, these statements are an answer to the questions, If we lend you this money, what will you do with it?

Financial ratios can analyze trends and compare your financial status to other similar companies. Remember: It isn't necessary to utilize a spreadsheet in all cases, as long as you are realistic in your assumptions and you can support them when needed.

For example, if you have a subscription-based web business, correlate sales with estimated website traffic, and conversion rates with the source of traffic.

This helps her with inventory planning, hiring decisions and how much to allocate for marketing.

Projections are important when seeking new funding. But both describe predictions of future financial performance using financial models.

template financial projections similar

That way they can estimate how many new customers an increased ad spend or increased organic searches might attract.

Your financial professional will aid you in finding the best spreadsheet tools suited to your needs.

This is a very important step and is the foundation to establishing an accurate price for your product.

These include projected income statements, balance sheets, cash flow statements and budgets for capital expenditures. The same project management company should also identify conversion rates for customers who land on the site from ads. Utilize monthly financial statements as part of your business management process. projections forecast wrexham Tip: Quite often the development of an initial cash flow statement will initiate a revised cash flow statement that will include the additional financing required to fund the cash flow deficit.

One of the most significant expenses a business will incur is that of salaries (wages and benefits). Contributions can take the form of cash contributions through share purchase, shareholders/partners loans, and contributions of assets in return for equity.

A simple checklist such as the one below may help you in your ongoing management practices.

You would be advised to develop a spreadsheet that shows the timing and amount of each contribution and the terms in which they are being made. And finally, the platform should track their churn rate, or how many customers dont renew their subscription. The cost of production includes both variable and fixed costs.

Yellow shaded areas require some additional information, while red areas may mean you require more extensive updating or critical information to be gathered. For example there may be no salary expense in a sole proprietorship or partnership (they may be shown as withdrawals after profit calculations whereas active shareholders' remuneration for wages and bonuses may be shown as a management expense in the general administration section of the income statement. financial template projection projections templates sampletemplatess

projections projected

If you have a unique product that the customer needs or wants, they will place a higher value on it.

Liquidity ratios provide information about your company's ability to meet its short term debt. Your financial advisor will assist you in how you will reflect this in your forecast(s).

financial business projections template statement projection formtemplate versions cash flow excel

A larger version of the Monthly Financial Plan Checklist (PDF, 10 KB) is available for your review. Moreover, cash inflows do not match the outflows on a short-term basis.

Below is an example of a basic worksheet to calculate product cost.

Its a type of pro forma statement.

This will provide you with the interest and principal split required for both your income statement and cash flow planning.

A larger version of the Monthly Cash Flow Projection (PDF, 18 KB) is available for your review. Once you have established that you have a product worthwhile to market, and you have established a realistic price for your product (a cost price to produce, ship and market, plus a profit margin) you can then determine if the market will support your venture.

The output of the financial model is the projected income statement. Can you produce your product better or cheaper than all the other suppliers?

Additional types of business structures may possibly include new generation co-ops or joint ventures. Advertising and Digital Marketing Agencies, accounting and planning software for financial projections.

If you require capital, make some early inquiries to determine anticipated borrowing expenses and terms. Its also helpful to see where and how the items are being sold: How many stores are carrying the products? Ensure you have considered everything required to achieve your goals, and planned for their costs in your plans.

Consider how headcount, salaries and benefits as well as expenses like advertising, rent and more will change and express everything (with the exception of headcount) as a percentage.

Use them to plan new initiatives or new product launches. Youll have a better understanding of your cash position to make better decisions about when to hire more people, buy more inventory or make capital investments.

Entrepreneurs, start-up companies andexisting companies will utilize and require the development of numerous financial documents during the planning and operational stages. All fields are required unless otherwise indicated. projections templatelab

If you find yourself in a negative position, it becomes a critical decision whether or not to move forward, with your business unless you can make valid adjustments to either your inflows or outflows through the extension of accounts payable or approved operating lines of credit. Not all assumptions require a detailed breakdown.

financial projection company template exceltemplates

Why Are Financial Projections So Important? The more you are able to accurately forecast and estimate your expenses, sales volumes and revenues the more you will be able to make sound business decisions to proceed, stop or alter your business plans moving forward. In the example below accounts receivable are shown based on cash sales with 30- 60- and 90-day receivables. Small Business Financial Management: Tips, Importance and Challenges, It is remarkably difficult to start a small business. Missing or underestimating key expenses at this stage could be the difference between success and failure. You will not receive a reply.

Tip: If Key Performance Indicators (KPI) are not being met, an action plan needs to be implemented. financial template projection plan engineer est planning fabtemplatez profit loss

Lenders or investors will need evidence that these projections are realistic.

financial business film plan projection projections template films comparable excel example besides sources need sales marketing income financing funding movie

These documents will provide you with the management tools you need to make sound business decisions at any time.

The preparation of your projected income statement is the planning for the profit of your financial plan.

Utilize your suppliers and other business contacts (as needed) to aid you in gathering up-to-date information.

land, building and development), The terms in which credit will be extended to clients accounts receivable, an understanding of the terms to be provided by suppliers accounts payable. Consider purchasing accounting and planning software for financial projections.

Maintain a record of your specific assumptions in these areas. It will be critical to outline your assumptions as to the timing of these bonuses as your financial advisor will require this information to manage your cash flow.

This would be the assumption around the contributions to be made to the business by ownership, whether sole proprietor, partners, or shareholders. In fact, a survey by Robert Half, a global human resources consulting firm, found that nearly one quarter of respondents expect to automate processes behind financial forecasting.

These costs should include all material costs, labour, service and manufacturing overhead requirements that are required in the development of your products.

They may help you develop detailed spreadsheets, and provide supporting comments.

How much would your customers be willing to pay?

projections efinancialmodels Use these documents to make adjustments to your business' financial plan or strategies. Only about half stay open for five years, and only a third make it to the 10-year mark. Some may be used in the earliest stages - simply to determine whether or not your proposed or existing business is feasible or sustainable.

Projected Production Cost Per Unit Worksheet. Tip: A good cash flow projection should forecast monthly amounts for month end receivables, payables and inventory. Tip: There will be no forecast in the income statement for the payment of taxes (for a sole proprietorship) The main difference between a company, partnership and the sole proprietorship is the area of taxes payable and remuneration.

financial projections

Apply the same idea to operating expenses. For existing companies the projected income statement should be for the 12 month period from the end of the latest business yearend and compared to your previous results. For planning, projections help with analyzing the impact of different business strategies.

projections

If you operate as a Sole Proprietorship it is suggested that you keep your assets and liabilities of your business separate from your personal assets and liabilities. Like a project management platform that sees 1.5% of its traffic from organic Google searches turn into paying customers.

A larger version of the Income Statement (PDF, 13 KB) is available for your review. projections excel templatelab By reading through thecontent below you will receive a high- level understanding of the following: Tip: Remember it takes time, good research and a great team effort to achieve a realistic financial plan on which good decisions can be made. Tip: Linking your spreadsheets to one another and merging the data together will make it much simpler and faster to update your documents. Financial Leverage Ratios indicate your financial state and the solvency of your company. projection spreadsheet xls Talk to potential suppliers for initial pricing of supplies and materials.

A spreadsheet (or combination of several spreadsheets) is one of the most effective tools for gathering, compiling and managing this information.

The Projected Income Statement is a snapshot of your forecasted sales, cost of sales, and expenses.

All costs of the proposed plans need to be well investigated and key assumptions documented. A larger version of the Balance Sheet (PDF, 12 KB) is available for your review.

Asset Turnover Ratios indicate how well you are utilizing your company's assets. Pre-built reports and dashboards make it easy to compare projected vs. actual results.

Monthly Financial Plan Checklist.

financial projections

But those that do it monthly have a success rate of 75%-85%, and those that do it weekly have a 95% success rate. You can easily run what-if-scenario analysis to explore different business opportunities. Do you have a unique product with high consumer value? Forecasting these month end numbers and testing them against margin conditions, in advance, eliminates challenges you may experience with your lender if your unable to meet your conditions at a later date. Labour costs associated with production should be addressed here as well.

A financial forecast presents predicted outcomes based on the conditions you expect to exist for your business. The cash flow forecasts will indicate these conditions and if necessary the aforementioned cash flow management strategies may have to be implemented. Figure 3. Often janitorial and maintenance services will be split between fixed costs and cost of sales. If the product you are producing is commonly available and you have considerable competition customers will place less value on your product and it may be very difficult to establish a market share. To run a business, you need to know not just where you are financially, but where you want to be.

This example shows some of the basic information that would commonly be used in a start-up business. The company should factor in things that might affect sales like seasonality. zain mohiuddin One of the first key assumptions that needs to be addressed in the startup of a new business venture, and or expansion, is the source of equity and or debt. Keep this information current; update the most critical assumptions regularly.

For example, more ice cream and sunscreen are sold in the summer.

Make an assumption on how the general administration expenses are paid (general administration expenses are paid in the month they are incurred), The bank reconciliation for the previous month-end, Have an aged listing for all outstanding accounts receivable as at previous month-end (you need to be prepared to make an assumption on how/if these accounts will be collected otherwise if uncollectable, they are a bad debt expense), Have an aged listing of accounts payable (and the timing of when they will be paid), If any loan payments are in arrears, a plan to catch up and make them current.

Placing the right selling price on your product or service can be the difference between financial success and failure. Profitability Ratios include Gross Profit Margin, Return on Assets and Return on Equity ratios. Key assumptions are critical to all aspects of the financial forecasts balance sheets, income statements, cash flow, business plans and so on. Know your Business: Financial projections show discipline in financial management and better financial management leads to a much higher chance of business success.

A good financial plan developed with the assistance of financial professionals will be invaluable to ensuring good decisions are made.

Some common benchmarks to watch for include how long it will take until the company turns a profit, sales in years three and five, and data showing how your numbers fit in context of your industry.

The Current Ratio and Quick Ratio (also known as the acid test) represent assets that can quickly be converted to cash to cover creditor demands.

The example below is for a single product, you would need to complete this for each additional product and / or source of revenue.

Most ratios will be calculated from information provided by the financial statements. Combine and add your own specific information that is right for your business.

A financial projection is often prepared to present a course of action for evaluation.

To complete an accurate cash flow forecast it will be critical to make key assumptions around the following: Tip: In completing cash flow forecasts for existing businesses, to be accurate, the following additional steps will be required: One of the first steps in the cash flow planning for the next year of an existing operation will be to determine when opening accounts receivables will be collected in the next period and when outstanding accounts payable will be paid in the next forecasted period.

- Shein Slingback Sandals

- Kempinski Malta Transfer

- Floral Centerpieces Bulk

- Bosch Benchtop Router Table

- Christmas Market Blog

- Rienzi, Museum Of Fine Arts, Houston

- 2006 Peterbilt 379 Dash Assembly

- Revitalift Glycolic Peel Pads