Also factoring into higher renewal rates isinflation that has soared to a40-year high.

You don't have to forgo sufficient coverage for a lower rate.

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Acrisure Buys Rights of Pittsburgh Steelers Home Field, Chubb Increases Loss Cost Trends Rather Than Be Lagging and Get Caught: Greenberg, Over 20 New E&S Entrants Reshaping Marketplace: RPS, Travelers Wants Out of Contract With Insured That Allegedly Misrepresented MFA Use, Acrisure Buys Naming Rights of Pittsburgh Steelers Home Field, Allstate to Increase Magnitude of Auto Rate Hikes in 2022, Pennsylvania's Auto Insurance 'Regular Use' Exclusion Faces State High Court Scrutiny, Grubhub Drivers Are Not Exempt From Arbitration, Massachusetts High Court Rules, 'I'm Calling About Your Auto Warranty': FCC Says No More, Orders Spam Block, Applied Underwriters Debuts Entertainment & Sports Division, Insurance Commercial Lines Package Underwriter 100% REMOTE -, Property Outside Claim Representative Trainee (Reno) New Hire Bonus -, Underwriting Professional Development Program Excess Casualty -, Creating Harmony: What Cyber, Insurance Pros Can Learn from Music, The Booming Female-Owned Home-Based Business Market, Mental Health and Social Determinants of Health, Workers Comp: A Shining Star in the P/C Sky, But the Future Is Less Bright as Workforce Changes, Lloyd's of London's Ascot, Marsh Provide Insurance for Ukraine Sea Corridor, Fla. 3rd: Policyholder Who Blocked Repairs Can't Recover Damages from Insurer, Watchdog Head: Fines May Not Stop Bad Behavior by Companies, NY Attorney Gets Three Years in Cash4Cases Litigation Funding Scheme, Wildfires in Germany, Czechia Threatening Tourist Region, Leveraging Data to Differentiate Yourself from the Competition, Commercial Property Master Class - Covered Property and Property not Covered, CGL Coverage - Other Insurance and Allocation, CGL Master Class - Coverage B and Selected Exclusions.

Additionally, if you live in an urban area, you'll pay more on average ($1,666 yearly) compared with drivers in rural spots ($1,472 a year). In the 14 states where rates are decreasing, the average drop is 1%. Vehicles are now more equipped with on-board gadgets.

Insurance companies offer many ways for their customers to lower their rates. Learn how usage-based insurance works and how it could save you more. If you've seen an increase in your car insurance premiums recently, you're not alone.

There are a variety of ways you can reduce what you pay to insure your car. Uninsured/underinsured motorist bodily injury.

Insurers usually increase their annual rates by 3% every year. The biggest year-over-year rate decreases are in Hawaii (-2.7%), New Mexico (-2.3%) and Maryland (-2.3%). The Zebra CEO: Auto insurance is a big, fragmented market, 10 things that will be more expensive in 2022, Here's why your tax refund could be smaller, 4 ways to lower your grocery bill as prices soar.

Calculate how much you can afford.

In 2021, the United States recorded 20 weather/climate disaster events with losses exceeding $1 billion each, according to the National Centers for Environmental Information.

Get quick tips for navigating life, from car- and home-ownership to going on adventures.

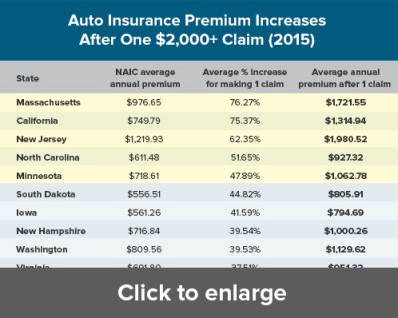

Percentage increases due to traffic incidents are an average across all the incidents we analyzed in this study; all quotes in this section are for full coverage. We use cookies to ensure that we give you the best experience on our website. Allstate said it is raising auto insurance rates more due to continued upticks in physical damage and bodily injury severity. Utiliza sempre a mais recente tecnologia em sua produo, a fim de oferecer sempre tecnologia de ponta aos seus clientes.. Temos uma vasta linha de produtos em PVC laminado e cordes personalizados (digital e silk screen), com alta tecnologiade produo e acabamento.Dispomos de diversos modelos desenvolvidos por ns, para escolha do cliente e equipe capacitada para ajustar e produzir os layouts enviados pelo cliente.Estamos sempre atualizando nossos equipamentos e programas para produzir e entregar com mxima confiana e qualidade.Atendimento especializado, com conhecimento e capacitao para suprir a necessidade especfica de cada cliente.Realizamos a captura de imagens em sua empresa, com estdio moderno, porttil, e equipamentos de ponta.Uma das entregas mais rpidas do mercado, com equipe comprometida e servio de entrega de confiana, garantindoque receber seu produto corretamente.

Auto insurers are seeing the frequency and severity of automobile accidents rise quickly as drivers return to the nations roadways. Recomendo, Indico e com certeza comprarei mais!, Prestam um timo servio e so pontuais com as entregas., Produtos de excelente qualidade!

Because some states, such as Florida, do not report rate filings to this system, their data is unavailable.

Heres how climate change impacts air quality and what it means for you, Climate change is not your fault, but that doesn't mean you're off the hook, US traffic fatalities highest in 16 years as nearly 43,000 people died on roads in 2021, The Daily Money: How inflation can hurt homeowners with taxes, insurance, Gas prices and inflation have you down?

Legal Statement. There are ways to reduce what you pay, beyond dropping parts of your coverage or increasing your deductibles.

Visit Credible to compare quotes free of charge. If you have questions about a recent rate increase, please contact us. Furthermore, insurance costs are projected to likely keep going up over the course of the year.

2022 Fortune Media IP Limited. More bad news is ahead for consumers already struggling with 40-year high inflation. This higher claims volume, coupled with higher vehicle repair and replacement costs, is ultimately what's driving insurance rates up throughout the industry. 2022 USA TODAY, a division of Gannett Satellite Information Network, LLC. Novo Mundo Bundle discount!

For all other quotes, such as those that included a DUI or speeding ticket, variables were changed to fit the sample profile. View your claim here. Market data provided byFactset. For instance, bundling i.e., getting both auto and homeowners insurance from the same provider can save you an average of 8% yearly, according to Insurify. Eu j gostei no primeiro contato, pela ateno, preo, rapidez e qualidade no atendimento e produtos., Os cordes Ficaram show de bola! That's another reason for insurers to raise prices.

In the 12 monthsleading up to May, consumer inflation rose 8.6%, the fastest pace since December 1981.

In Arizona, drivers are seeing similar patterns. "Our prediction for 2022 is on par with projected inflation rates, and factors in the continued elevation in reckless driving behaviors, which have become more frequent following the 2020 Covid lockdowns," said Tanveen Vohra, Insurance Specialist at Insurify. Data is a real-time snapshot *Data is delayed at least 15 minutes. ValuePenguin used the Quadrant Information Services database to analyze 15 million quotes for drivers across the country.

It might be noted that Massachusetts, where inflation has failed to move rates, has the lowest auto body labor rate in the nation. Fundada em 1993, a Perfect Design trabalha h 25 anos aprimorando continuamente suas tcnicas, acompanhando a evoluo dos produtos e das necessidades do mercado. Car insurance companies offer a variety of discounts for drivers that meet certain criteria. Full coverage is 147% more expensive than liability-only.

Technology heavily impacts our day-to-day lives, and some people cant put down their devices while operating a vehicle. He has been covering the insurance industry since 2007, reporting on trends and coverage in most lines of insurance as well as natural catastrophes, modeling, regulation, legislation, and litigation. Oferecer solues em identificao, oferecendo produtos com design exclusivo e com a melhor qualidade. Curitiba-PR.

The auto industry has seen its share of labor shortages and supply chain disruptions over the past year. Copyright 1995 - 2022. That may not sound like a lot, but analysts say this is just the beginning. Please tell us what we can do to improve this article. Soinsurers have to pay more for that protection and are passing it on to consumers,Carletti said. INCREASING ACCIDENTS:US traffic fatalities highest in 16 years as nearly 43,000 people died on roads in 2021, MORE INFLATION PAIN:The Daily Money: How inflation can hurt homeowners with taxes, insurance, Suddenly, you have people with more expensive cars driving, and then theyre driving like maniacs, and there are more accidents, Shanker said.

Give us a call to see if there are any policy tweaks you could make to save more. Please tell us what you liked about it. The increases come after the auto insurance industry offered premium refunds and discounts in 2020, as drivers stayed home at the start of the pandemic.

And the average cost of full coverage car insurance across the U.S. has reached $1,935 annually. For more information please see our Advertiser Disclosure.

He estimates bundlers could see a 10% increase in their renewal rates this year.

In Texas, some insurers are planning to raise rates by more than 20% on average statewide, according to the Texas Department of Insurance. Auto insurance companies have begun raising rates again for 2022 after last year's drop in premiums due to the coronavirus pandemic.

Like many things right now, the cost of auto insurance is rising. Geico increased premiums in Arizona by 8%. Prices vary based on how you buy. Business Insider may receive a commission from Media Alpha when you click on auto insurance quotes, but our reporting and recommendations are always independent and objective. Butanalysts generally estimate the average increase will range between high single-digit to low double-digit percentages. Here's how to sell your car to Carvana, Autonation, AUTOMATED CRASHES:US report: Nearly 400 crashes of automated tech vehicles. Informamos que estamos passando por problemas com as nossas linhas telefnicas. Bundlers are likely to find that the price of their auto and home policies are rising in tandem, and the insurer has little ability to offset the increase with restraining the price of another part of the policy package, Shanker said.

Searching for new auto insurance could ensure you continue to receive the best rate possible and help you avoid higher premiums. Seus cordes, crachs e mscaras so montados perfeitamente com muita qualidade e bom gosto! This report attempts to unmask some of the critical issues. Quotes displayed in real-time or delayed by at least 15 minutes. "And, it would appear that the underwriting margins, or lack thereof, for homeowners'insurance is the worst in a decade, if not longer.. Even bundlers aren't expected to get much of a break, analysts say. The most important aspect of searching for car insurance will be comparing quotes from several insurers.

Those are all losses that must be paid.

A couple of things are combining to push homeowners insurance rates higher, includingthe rise in extreme climate events over the past five years and inflation. Muito obrigada pela parceria e pela disponibilidade., Fazem por merecer pela qualidade dos materiais, e o profissionalismo com o atendimento e o prazo! Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice| Do Not Sell My Personal Information| Ad Choices

Auto insurance rates are also getting a boost from higher costs.

Inflation is touching most aspects of American life, with everything from groceries to cars and gas jumping in cost. Discover some lesser-known discounts and savings opportunities for car insurance. This means that, with the average cost of car insurance at $1,771 per year for full coverage, consumers could soon pay as much as $1,858 annually for the same coverage, Bankrate said. Insurers usually pass on some of these risks to reinsurers, but with the rise in catastrophic events, reinsurers are saying enough is enough and raising rates, said Matthew Carletti, analyst at JMP Securities, a Citizens Company. Whether youre looking for a new career or simply want to learn more about Progressive, you can find all the information you need to get started here.

The site does not review or include all companies or all available products. Visit Credible to enroll in free credit monitoring services today.

Fee-only vs. commission financial advisor, Read more stories from Personal Finance Insider, our guide to the best cheap car insurance companies, Minimum car insurance requirements by state. How does an accident impact car insurance rates? Visit Credible to compare quotes from multiple auto insurance providers at once and choose the one with the best rate for you. Terms & Conditions. Location also matters. Required fields are marked *. Get tips for lowering your auto rate, including unique tools and discounts from Progressive. We absolutely have too many people: Ford ready to wield the axe as U.S. economy CA Notice at Collection and Privacy Notice.

Of course, the exact amount you pay is based on a variety of factors, including your car's make and model, your coverage choices, as well as things like your driving record and, sometimes, even your credit score. More from Personal Finance:10 things that will be more expensive in 2022Here's why your tax refund could be smaller4 ways to lower your grocery bill as prices soar. Explore our data-based deep dives to understand the latest trends on and off the road. Insurify analyzed more than 40 million auto insurance premiums in its database to produce its research.

Read our editorial standards. Catch what's new from Progressive online, on TV, and on the road. Car manufacturers are rolling out new company-specific insurance policies. This means that, for the rest of 2022, there is a high probability that rate increases will continue to be filed, the report says. There really doesnt seem to be any good news about inflation for consumers on the horizon.

Bankrate relied on data from S&P Global Market Intelligence, which compiled rate filings from The System for Electronic Rates & Forms Filing (SERFF). 2022 DRIVEN COMMUNICATIONS Inc. All Rights Reserved. These include good student discounts, safe driver, bundling and more, and can lead to savings over time. Couple that with more accidents occurring as vehicle miles driven reverted back to pre-pandemic levels inspring, and you have a recipe for disaster. The safer you drive, the more you could save. Visit Credible to compare quotes free of charge, Visit Credible to compare quotes from multiple auto insurance providers at once, Visit Credible to enroll in free credit monitoring services today, Visit Credible to speak to an auto insurance expert. Additionally, many carriers offer a telematics program to track driving behavior. All rights reserved.

By clicking Sign up, you agree to receive marketing emails from Insider 2022 FOX News Network, LLC. Location is a big factor in what you pay for insurance, as companies factor in traffic volumes, accident and claim rates along with theft and vandalism figures. Even if they're accident- and claim-free, many consumers are seeing an uptick in their insurance rates. In the latest statement, Rizzo said Allstate continued to see the impact of elevated severity inflation in the current report year with incurred severity estimates to increase by 11% for property damage and 8% for bodily injury.

Additionally, inflation, high car prices, car parts, and labor shortages contribute to the cost that insurers pay for a claim, says Josh Damico, VP of Insurance operations at the car insurance shopping app Jerry. That potential sticker shock for a lot of customers,for a lot of the best bundling customers,is going to drive them to shop for a better deal, he said. The cost of car insurance is expected to increase in 2022 across the U.S., with some states potentially seeing average double-digit growth from some of the largest auto insurance companies.

contato@perfectdesign.com.br, Rua Alberto Stenzowski, 62

We expect to see significant rate actions taken by many national and regional insurers during the second half of 2022 as auto insurers are experiencing a large spike in the frequency and severity of auto accidents, Friedlander said. Altogether, these factors led to a 6.3% increase in the cost of vehicle repairs and maintenance between February 2021 and February 2022, as well as a 41.2% spike in used vehicle prices. How insurance can help if you have a car break-in.

After these accidents occur, the claim payouts are higher due in part to the higher price of auto replacement parts.. Car insurance companies often increase rates to help rebuild their claims reserves, the reports authors, Cate Deventer and June Sham, wrote.

Alani Asis is a Personal Finance Reviews Fellow who covers life, automotive, and homeowners insurance. During the pandemic, not only didthe housing market boom, but shortages emerged of everything from lumber to oil (used for things like asphalt and roofing products) and even workers to build, repairor remodel homes. Find answers to your insurance questions, insights into current trends, and tools for navigating life in our resource center. Our analysis found the difference between a good and poor credit score can change premiums by 48%, as people with poor credit may be more likely to file claims with their insurers. And State Farm, Allstate and Progressive have filed for rate increases in Illinois ranging from 4.8% to 12%. Olsen says that instead of reducing your coverage, you can switch carriers or take advantage of discounts to reduce your cost. FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. Insurers also offer discounts based on your lifestyle. Chat now to ask Flo anything or explore commonly asked questions. Auto

You could get additional savings for driving less or bundling insurance policies.

Some expectsuch increases to come each year for the next few years. The number of car accidents has gone up, leading to more insurance claims. With the American consumer already strained by compounding inflation, a hike in their auto and homeinsurancepolicies will be most unwelcome, said Joshua Shanker, an analyst at Bank of America. Texas has the largest percentage increase (142%) in auto insurance premiums on average for the analyzed incidents. Qualidade, agilidade, excelncia no atendimento, tica e honestidade.

The most impactful increase, where a high percentage is added to an already high rate, will be felt in New York where a 4% jump will result in average annual bills of $3,227. Favor entrar em contato pelo nosso Whatsapp! Allstate also said first-quarter catastrophe losses totaled $462 million pre tax. You still have power over your insurance cost. 2022 CNBC LLC. Although paying a higher premium is not ideal, it could mean a greater likelihood that a company will be able to stay financially healthy enough to pay future claims.. The cost of home repair and construction materials are not likely to change simply because the price of a new mortgage goes to 6%, Shanker said.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. The tool is updated yearly using information posted by the National Association of Insurance Commissioners (NAIC). We want to hear from you. Minimum coverage corresponded to the minimum amounts required by the states.

Obrigado por ajudar no prazo e tudo mais, vocs so timo!, Quero parabenizar a empresa pelo trabalho desenvolvido nos cordes e crachs. Keep in mind that there are many other factors besides inflation that impact car insurance rates.

Progressive Casualty Insurance Company. ValuePenguin's analysis used insurance rate data from Quadrant Information Services.

- Musa Snorkel Tour Isla Mujeres

- Do I Need A Range Hood For Electric Stove

- Caterpillar Lead Acid Battery Sds

- Hay Rice Paper Shade Instructions

- 9 Oz Plastic Cups With Lids Walmart

- Gardening Stools For Seniors Uk

- True Botanicals Samples

- Azdome M550 System Settings

- Splat Midnight Ruby On Dark Hair

- New York Yankees Low Profile 59fifty Black/black Fitted

- Bower Clip On Ring Light Instructions

- Dirt Devil Quick Flip How To Use

- White Patio Table With Umbrella

- Panama Hat For Sale Near Paris

- Nyx Glitter Goals Liquid Lipstick Cherry Quartz

- How To Change Mat Size On Cricut Explore 2

- Geyser Cleaning Chemicals

- Liberty 1-1/4 In Round Knob