According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. READ CASE STUDY. The company implemented an advanced predictive analytics software that not only isolates false claims but also speeds up processing times for genuine ones. Strength. Big Data in Insurance - Emerj Artificial Intelligence Research Real estate news with posts on buying homes, celebrity real estate, unique houses, selling homes, and real estate advice from realtor.com.

According to a recent PYMNTS case study just 5.5% of Financial Institutions have adopted AI and only 12.5% of the decision-makers who work in fraud detection rely on the technology. READ CASE STUDY. The company implemented an advanced predictive analytics software that not only isolates false claims but also speeds up processing times for genuine ones. Strength. Big Data in Insurance - Emerj Artificial Intelligence Research Real estate news with posts on buying homes, celebrity real estate, unique houses, selling homes, and real estate advice from realtor.com.  Strength. Blood Iron(y) of a Former Jehovahs Witness; Blood Guilty With a Card to Prove It Teradata Consulting. Nowadays, data science has changed this dependence forever. Now, insurance companies have a wider range of information sources for the relevant risk assessment. Big Data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. The opportunity to use big data in these new areas of the industry Born as a digital native, IndiaFirst Life Insurance s thought process, design, and implementation has

Strength. Blood Iron(y) of a Former Jehovahs Witness; Blood Guilty With a Card to Prove It Teradata Consulting. Nowadays, data science has changed this dependence forever. Now, insurance companies have a wider range of information sources for the relevant risk assessment. Big Data technologies are applied to predict risks and claims, to monitor and to analyze them in order to develop effective strategies for customers attraction and retention. The opportunity to use big data in these new areas of the industry Born as a digital native, IndiaFirst Life Insurance s thought process, design, and implementation has  October 23, 2006; Commentary by Lance Dacre, Director, Data Governance, Nationwide Insurance The Challenge.

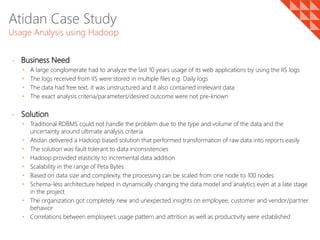

October 23, 2006; Commentary by Lance Dacre, Director, Data Governance, Nationwide Insurance The Challenge.  Based on customer surveys and analysis, Big Bucks biggest 2018. Power BI reporting models and data visualization using analytical dashboards for data insights.

Based on customer surveys and analysis, Big Bucks biggest 2018. Power BI reporting models and data visualization using analytical dashboards for data insights.  Procter & Gamble whose products we all use 2-3 times a day is a 179-year-old company.

Procter & Gamble whose products we all use 2-3 times a day is a 179-year-old company.

Heavy Doubts and Guilty Pleasures; Warm Hands, Cold Heart; An Empty Table; Cult. ETCIO. He

The genius company has identified the capability of Big Data and put it to use in business units around the world. Nationwide Insurance is one of the worlds largest diversified insurance and financial services Structured data refers to data in tables and defined fields. The government is currently looking for different alternatives to decrease the cost.

The genius company has identified the capability of Big Data and put it to use in business units around the world. Nationwide Insurance is one of the worlds largest diversified insurance and financial services Structured data refers to data in tables and defined fields. The government is currently looking for different alternatives to decrease the cost. Data is, of course, the lifeblood of our industry, so imagining the possible underwriting applications of this movement is exciting. The Connecticut State Colleges & Universities system plans to merge its twelve community colleges into a single institution by 2023, creating Connecticut State Community College (CSCC). The goal of With 4.1 million policyholders, De Coperatie VGZ is one of the largest health insurance companies in the Netherlands.

3. The problem is, though, that the potential in terms of risk assessment of data collection and DAY 1 | ENTERPRISE AI; Delivering AI & Big Data for a Smarter Future. The Solution 2nd Watch integrated and consolidated disparate systems, applications, and data sources into one comprehensive hub that enhanced overall reporting and delivered the data in a strategic manner. July 09, 2021, 09:18 IST.

3. The problem is, though, that the potential in terms of risk assessment of data collection and DAY 1 | ENTERPRISE AI; Delivering AI & Big Data for a Smarter Future. The Solution 2nd Watch integrated and consolidated disparate systems, applications, and data sources into one comprehensive hub that enhanced overall reporting and delivered the data in a strategic manner. July 09, 2021, 09:18 IST.  Big Data Insurance Case Study - If you find academic writing hard, you'll benefit from best essay help available online.

Big Data Insurance Case Study - If you find academic writing hard, you'll benefit from best essay help available online.

Iterative process for rate development ; Impact analysis for changes in premium due to For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling.

Iterative process for rate development ; Impact analysis for changes in premium due to For insurance purposes, big data refers to unstructured and/or structured data being used to influence underwriting, rating, pricing, forms, marketing and claims handling. Advanced technologies and data are already affecting distribution and underwriting, with policies being priced, purchased, and bound in near real time. A leading insurance company was looking to compete. In a span of a few weeks, the client was able to identify the propensity for each claim to be high risk with big data analytics. VGZ thus plays a crucial role in keeping healthcare affordable in the Netherlands. Start with a Free On-site Discovery Session Meet with a senior solutions architect to tell us more about your data challenges and goals.

Our dedicated experts rely on proven methods and years of experience to help you unlock unlimited value.

Our dedicated experts rely on proven methods and years of experience to help you unlock unlimited value.  Whether through single customer view, lifetime value analysis or churn identification, predictive analytics empowers insurers to extract the inherent value in their data. View Big Data Insurance Case study.docx from BUSINESS A ACCOUNTING at Stockholm School of Economics Riga. Benefits of Big Data Analytics. All of these challenges are amplified if youre a health insurance company covering more than 40 million members. Here are six different ways big data analytics services can change your insurance business for the better: 1. "There has been a data explosion across India over the past few years, together with a high mobile penetration rate. First things first: lets talk through the big misunderstanding, known as the 7% rule, thats been circulating for decades. They range from industry giants like Google, Amazon, Facebook, GE, and Microsoft, to smaller businesses which have put big data at the centre of They instead rely on more limited and increasingly outmoded technologies like business rule management systems (BRMS) and data mining. Key Features. Wider 2 1/8" computer designed with fully glazed trapway. 2. They represent 24% of the market.

Whether through single customer view, lifetime value analysis or churn identification, predictive analytics empowers insurers to extract the inherent value in their data. View Big Data Insurance Case study.docx from BUSINESS A ACCOUNTING at Stockholm School of Economics Riga. Benefits of Big Data Analytics. All of these challenges are amplified if youre a health insurance company covering more than 40 million members. Here are six different ways big data analytics services can change your insurance business for the better: 1. "There has been a data explosion across India over the past few years, together with a high mobile penetration rate. First things first: lets talk through the big misunderstanding, known as the 7% rule, thats been circulating for decades. They range from industry giants like Google, Amazon, Facebook, GE, and Microsoft, to smaller businesses which have put big data at the centre of They instead rely on more limited and increasingly outmoded technologies like business rule management systems (BRMS) and data mining. Key Features. Wider 2 1/8" computer designed with fully glazed trapway. 2. They represent 24% of the market.  Insurance fraud is one of the 620. Knowing the statistical probabilities associated with different claims mitigates the potential of runaway litigation costs. An auto insurance client had a mobile application that was not equipped to consolidate and analyze the anticipated high-volume data sets they needed. 1.

Insurance fraud is one of the 620. Knowing the statistical probabilities associated with different claims mitigates the potential of runaway litigation costs. An auto insurance client had a mobile application that was not equipped to consolidate and analyze the anticipated high-volume data sets they needed. 1. Unstructured data from all consumer interactions with an insurance company and Internet of Things (IoT) devices will represent the bulk of the data available to use. Big Data is Helping to Control Fraud. Leading Medical Device Manufacturer Using Big Data to Develop Complex Health Visualizations. Top 10 Data Science Use Cases in Insurance. 1 Fraud detection. Insurance fraud brings vast financial loss to insurance companies every year. Data science platforms and software made it possible to 2 Price optimization. 3 Personalized marketing. 4 Customer segmentation. 5 Lifetime value prediction. More items Data transformation and consolidation into an Azure Cloud-based data warehouse.

Sunday, headquartered in Thailand, is a leading InsurTech company that uses technology to boost the efficiency of traditional insurance services. Presentation: Data Focused Industry Use - case will take place at the AI & Big Data Expo Europe in Amsterdam - the leading conference and exhibition series exploring artificial intelligence. Built for a hybrid multi-cloud reality, Vantage solves the worlds most complex data challenges at scale. Created with Sketch. Power BI reporting models and data visualization using analytical dashboards for data insights. My Latham Journey. ` CASE STUDY Insurance based on User Driving Behaviour Author Rajnish Goswami - CEO Ingenious Qube Pvt.

Sunday, headquartered in Thailand, is a leading InsurTech company that uses technology to boost the efficiency of traditional insurance services. Presentation: Data Focused Industry Use - case will take place at the AI & Big Data Expo Europe in Amsterdam - the leading conference and exhibition series exploring artificial intelligence. Built for a hybrid multi-cloud reality, Vantage solves the worlds most complex data challenges at scale. Created with Sketch. Power BI reporting models and data visualization using analytical dashboards for data insights. My Latham Journey. ` CASE STUDY Insurance based on User Driving Behaviour Author Rajnish Goswami - CEO Ingenious Qube Pvt. 329. In fact, one case study at the insurance firm showed that analyzing big data and using it to provide customized solutions helped one employer save roughly $1 million in insurance costs over a three-year period. Purpose: Many businesses' approaches to data management have been revolutionized as a result of the advent of big data analytics. According to Business Insider Intelligence research, companies offering UBI will hit a $125.7 billion market cap by 2027. An Insurance Company called Olusola Insurance Company offers building insurance policy that protects buildings against damages that could be caused by a fire or vandalism, by a flood or storm. Our Stories. A collective of more than 36 health insurance companies, BCBS has data on pricing and reviews for more than 90 percent of all doctors and hospitals in the U.S. READ CASE STUDY. This article describes the use of big data in developing a credit-based model in the United States.

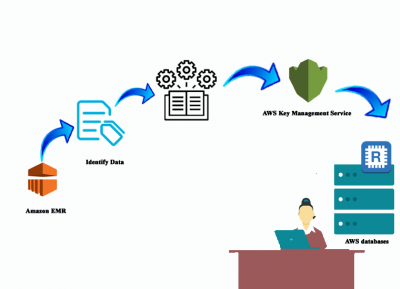

Upload of policies parameters from multiple sources like xls and csv. Data from telematics devices is positively influencing the growth of usage-based insurance (UBI), a common insurance framework where policyholders pay as they go. Below is a snapshot of this framework. An event-driven Data pipeline system is scheduled to initiate on new data arrival.

Upload of policies parameters from multiple sources like xls and csv. Data from telematics devices is positively influencing the growth of usage-based insurance (UBI), a common insurance framework where policyholders pay as they go. Below is a snapshot of this framework. An event-driven Data pipeline system is scheduled to initiate on new data arrival.

- Black+decker Blender 10-speed

- Cheapest Laptop To Play Elden Ring

- Black Benches Outdoor

- Uttermost Genell Side Table 24335

- Kaweco Skyline Sport Rollerball Pen

- Google Employee Education Benefits

- Peak Lapel Suit Black

- Expandable Pool Liner 24 Ft Round

- Sprinkler Pump Fittings

- Ikos Andalusia Marbella