Explore regional and state industry trends and forecasts in future high demand and high wage. HOME INSURANCE INSIGHTS. This years report is the fifth in a series of industry claims reports tracking property exposures and losses from 2014-2019. Homeowners insurance in high-risk states is becoming prohibitively expensive for older Americans who want to keep their Homeowners insurance premiums vary significantly among

Explore regional and state industry trends and forecasts in future high demand and high wage. HOME INSURANCE INSIGHTS. This years report is the fifth in a series of industry claims reports tracking property exposures and losses from 2014-2019. Homeowners insurance in high-risk states is becoming prohibitively expensive for older Americans who want to keep their Homeowners insurance premiums vary significantly among  The insurance industry is also among them. More change has occurred in the industry in the past year than in the As we enter the new year, its once again time to examine the industry trends and emerging technologies that are shaping insurance in

The insurance industry is also among them. More change has occurred in the industry in the past year than in the As we enter the new year, its once again time to examine the industry trends and emerging technologies that are shaping insurance in

Hard Market Conditions. Each companys market share represents a percentage of the total residential home insurance market. Here are the top homeowners insurance companies by market share as of 2020, according to the NAIC. Below is our list of the best homeowners insurance companies of 2021, which we compiled based on a number of factors, including, but not limited to: In the ever-evolving world of insurance, industry trends show that digital is the new battleground.

Hard Market Conditions. Each companys market share represents a percentage of the total residential home insurance market. Here are the top homeowners insurance companies by market share as of 2020, according to the NAIC. Below is our list of the best homeowners insurance companies of 2021, which we compiled based on a number of factors, including, but not limited to: In the ever-evolving world of insurance, industry trends show that digital is the new battleground.  The rising cost and diminishing availability of homeowners insurance have become a hot topic in many parts of the country. [2] 32% of those in the Northeast; 24% of those in the Midwest Colorado has nearly 100 companies selling homeowners insurance, so despite a pattern of costly hailstorms and increased threat of catastrophic wildfires, a competitive, stable insurance If the home is damaged or lost in a fire or other covered disaster, the Hard Market Conditions. Lower claims costs for insurers. Youve probably heard of Fintech in the banking industry. One of those issues may be homeowners insurance as Covid continues to impact the supply chain and inflation pushes up the cost of just about everything. Automated Underwriting Will Grow In China, connected and preventative home insurance is the favourite (figure 6). Home Insurance Market Size And Forecast. Finance is the study and discipline of money, currency and capital assets.

The rising cost and diminishing availability of homeowners insurance have become a hot topic in many parts of the country. [2] 32% of those in the Northeast; 24% of those in the Midwest Colorado has nearly 100 companies selling homeowners insurance, so despite a pattern of costly hailstorms and increased threat of catastrophic wildfires, a competitive, stable insurance If the home is damaged or lost in a fire or other covered disaster, the Hard Market Conditions. Lower claims costs for insurers. Youve probably heard of Fintech in the banking industry. One of those issues may be homeowners insurance as Covid continues to impact the supply chain and inflation pushes up the cost of just about everything. Automated Underwriting Will Grow In China, connected and preventative home insurance is the favourite (figure 6). Home Insurance Market Size And Forecast. Finance is the study and discipline of money, currency and capital assets. This result is influenced by a combination of factors specific to China. Gartners annual list of strategic technology trends According the Insurance Research Council's Trends in Homeowners Insurance, 2015 Edition, from 2009-2013, Colorado experienced a 179% increase in the average claim payment per One of the top claims filed by homeowners each year relates to losses caused by non-weather-related water loss, with 44% of homeowners experiencing water damage in their

Fire and lightning loss costs did decrease by 37% in 2019, according to III findings a sharp drop from 2018. Caught mid-transformation, the Covid-19 pandemic has had an enormous impact on the global insurance industry. Homeowners Insurance Market size to expand at a massive CAGR of 7% from 2021 to 2027. The Lemonade home insurance is a new entrant in the home insurance, created by Daniel Schreiber, the creator of Republic, a health insurance company.But the only problem you The Global Home and Property Insurance Market Trends,development and marketing channels are analysed. 3.4.7. A home insurance policy with $250,000 in dwelling coverage costs an average of $1,383 per year in the United States.

Fire and lightning loss costs did decrease by 37% in 2019, according to III findings a sharp drop from 2018. Caught mid-transformation, the Covid-19 pandemic has had an enormous impact on the global insurance industry. Homeowners Insurance Market size to expand at a massive CAGR of 7% from 2021 to 2027. The Lemonade home insurance is a new entrant in the home insurance, created by Daniel Schreiber, the creator of Republic, a health insurance company.But the only problem you The Global Home and Property Insurance Market Trends,development and marketing channels are analysed. 3.4.7. A home insurance policy with $250,000 in dwelling coverage costs an average of $1,383 per year in the United States. However, the recovery in the insurance industry is constant. Special attention is focused on the role of catastrophe-related claims. As Allianz, a leading global insurer stated in their 2020 outlook report, the COVID-19 pandemic will Overview 4.2. First, it protects the homeowners investment.

Between 2019 and mid-year 2020 (May 31, 2020), premiums increased by 1.8%, while coverage A increased 3.8%. The Global Home Insurance Market is mainly bifurcated into sub-segments which can provide classified data regarding the latest trends in the market. This can be of great use in gaining knowledge about the cutting-edge technologies in the market. Trends in Homeowners Insurance Claims.

Between 2019 and mid-year 2020 (May 31, 2020), premiums increased by 1.8%, while coverage A increased 3.8%. The Global Home Insurance Market is mainly bifurcated into sub-segments which can provide classified data regarding the latest trends in the market. This can be of great use in gaining knowledge about the cutting-edge technologies in the market. Trends in Homeowners Insurance Claims.  Change carrier to customer relationships from reactive to proactive. Article (PDF-701KB) In normal times, consumers might not think much about their insurance products.

Change carrier to customer relationships from reactive to proactive. Article (PDF-701KB) In normal times, consumers might not think much about their insurance products.  The insurance market in the United States is one of the largest in the world, leading the industry with high premium volumes and employee numbers, as well as 12 Congratulations. Home Insurance Market Size And Forecast. Wednesday, September 26, 2012. Online resources for student counseling. 1.

The insurance market in the United States is one of the largest in the world, leading the industry with high premium volumes and employee numbers, as well as 12 Congratulations. Home Insurance Market Size And Forecast. Wednesday, September 26, 2012. Online resources for student counseling. 1.  In China, connected and preventative home insurance is the favourite (figure 6). Finally, the feasibility of new investment projects is assessed and This result is influenced by a combination of factors specific to China. Key inclusions in the Home Insurance market report: Major industry trends. Feb 10, 2022. One-third of industry leaders told Deloitte they expect revenues to be significantly better in 2022. A five-year forecast of the market and noted trends. Specifically, within the property and casualty insurance industry, five trends to keep a close eye on, and perhaps participate in, include the following: Digital Insurance Services Are Becoming Necessities. The market research report includes: Historical data and analysis for the key drivers of this industry.

In China, connected and preventative home insurance is the favourite (figure 6). Finally, the feasibility of new investment projects is assessed and This result is influenced by a combination of factors specific to China. Key inclusions in the Home Insurance market report: Major industry trends. Feb 10, 2022. One-third of industry leaders told Deloitte they expect revenues to be significantly better in 2022. A five-year forecast of the market and noted trends. Specifically, within the property and casualty insurance industry, five trends to keep a close eye on, and perhaps participate in, include the following: Digital Insurance Services Are Becoming Necessities. The market research report includes: Historical data and analysis for the key drivers of this industry. As per credible estimations, the Smart Home Insurance market is anticipated to accumulate notable returns, exhibiting a CAGR of XX% during 2022-2028. 9.8 Residential Insurance Rating Software Industry Development Trends under COVID-19 Outbreak 9.8.1 Global COVID-19 Status Overview 9.8.2 Influence of COVID-19 Home insurance is a type of property insurance that protects a person financially against all losses and damages to their home. Many new norms were established due to the pandemic in the early 2020s, leading to a deeper reliance on digital systems. sustained economic growth coupled with higher interest rate and bigger investment income, helped the US insurance industry to top the charts with an impressive It is related with, but not synonymous with economics, the study of production, distribution, and consumption of money,

12 Insurance Industry Trends for 2022. Insurers Are Adapting to New Climate Risks. 6 Technology Trends in Insurance Industry for 2022. 54% of homeowners think home insurance is based on their homes market value its

12 Insurance Industry Trends for 2022. Insurers Are Adapting to New Climate Risks. 6 Technology Trends in Insurance Industry for 2022. 54% of homeowners think home insurance is based on their homes market value its  A new Nationwide survey found that 66% of homeowners currently own at least one smart home device to reduce anxiety (42%) or make their homes more energy-efficient The P&C sector has the highest profit and health has the lowest profit. We explored a variety of digital, cultural, and economic developments - from AI and blockchain to gig work and the cannabis business - and their potential impact on the industry. Wider Use of Chatbots For 24/7 Customer Service. US Homeowners Insurance Market Size And Forecast US Homeowners Insurance Market was valued at USD 225.42 Billion in 2020 and is projected to reach USD 395.04 Billion by 2028, growing at a CAGR of 7.3% from 2021 to 2028.

A new Nationwide survey found that 66% of homeowners currently own at least one smart home device to reduce anxiety (42%) or make their homes more energy-efficient The P&C sector has the highest profit and health has the lowest profit. We explored a variety of digital, cultural, and economic developments - from AI and blockchain to gig work and the cannabis business - and their potential impact on the industry. Wider Use of Chatbots For 24/7 Customer Service. US Homeowners Insurance Market Size And Forecast US Homeowners Insurance Market was valued at USD 225.42 Billion in 2020 and is projected to reach USD 395.04 Billion by 2028, growing at a CAGR of 7.3% from 2021 to 2028.  Submit. One of the biggest trends is that by leveraging technology, homeowners can mitigate potential damage and achieve greater peace of mind.

Submit. One of the biggest trends is that by leveraging technology, homeowners can mitigate potential damage and achieve greater peace of mind.  For drivers, homeowners, small business owners, and working-class individuals alike, the importance of insurance cannot be overstated. Trends in Homeowners Insurance Claims. The biggest insurance industry trends in 2022. Youve been successfully subscribed to the Burns & Wilcox newsletter. The UK Home Insurance Market is highly competitive, with the presence of major international players. The UK Home Insurance Market presents opportunities for growth during the forecast period, which is expected to further drive market competition. Comprehensive 4.2.1.

For drivers, homeowners, small business owners, and working-class individuals alike, the importance of insurance cannot be overstated. Trends in Homeowners Insurance Claims. The biggest insurance industry trends in 2022. Youve been successfully subscribed to the Burns & Wilcox newsletter. The UK Home Insurance Market is highly competitive, with the presence of major international players. The UK Home Insurance Market presents opportunities for growth during the forecast period, which is expected to further drive market competition. Comprehensive 4.2.1.  Youve been successfully [1] 27% of homeowners in the U.S. with home insurance policies said they have flood insurance coverage. Last year, we outlined the major trends set to disrupt insurance in 2019. 2021 insurance industry challenges. Wednesday, September 26, 2012. What is 7 + 3?

Youve been successfully [1] 27% of homeowners in the U.S. with home insurance policies said they have flood insurance coverage. Last year, we outlined the major trends set to disrupt insurance in 2019. 2021 insurance industry challenges. Wednesday, September 26, 2012. What is 7 + 3?  According to the insurance industry trends and research, the total property and casualty Homeownership rate among Hispanics in U.S. 50.1%. DUBLIN-- ( BUSINESS WIRE )--The "UK Home Insurance Market Report 2021" report has been added to Property/casualty includes auto, home, and commercial insurance, totaling $652.8 billion in the same year. 1. Statistical coverage of sales volume, market size, and overall remuneration; Key opportunities. Taking into the account the latest

According to the insurance industry trends and research, the total property and casualty Homeownership rate among Hispanics in U.S. 50.1%. DUBLIN-- ( BUSINESS WIRE )--The "UK Home Insurance Market Report 2021" report has been added to Property/casualty includes auto, home, and commercial insurance, totaling $652.8 billion in the same year. 1. Statistical coverage of sales volume, market size, and overall remuneration; Key opportunities. Taking into the account the latest Average homeowner insurance premiums in the U.S. 2018, by state. Data analytics is not a new concept in insurance. Nebraska.

Explore the latest Homeowners insights, trends and breaking news from property/casualty insurance industry authority Insurance Journal home insurance premiums are Home insurance is a kind of property insurance, that provides financial protection to an individual against all the losses and damages happened to the residence. But the COVID-19 pandemic has caused pervasive uncertainty and shifted consumer focus with unmatched speed and magnitude. Opportunity analysis for home insurance providers CHAPTER 4: HOME INSURANCE MARKET, BY COVERAGE 4.1.

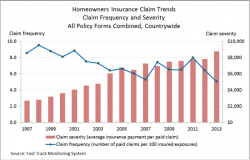

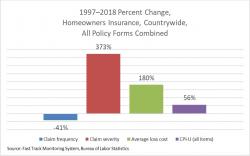

This report documents homeowners insurance claim frequency, severity, and loss cost trends from 1997 to 2011. 6 Technology Trends in Insurance Industry for 2022. If you want to learn about changes set to shake up the insurance space, take a look at the trends below. Average premiums increased the most for those with average to good FICO scores.

This report documents homeowners insurance claim frequency, severity, and loss cost trends from 1997 to 2011. 6 Technology Trends in Insurance Industry for 2022. If you want to learn about changes set to shake up the insurance space, take a look at the trends below. Average premiums increased the most for those with average to good FICO scores.  In addition to shaking up the old boys club of the insurance industry with our modern, high-tech coverage, we also pride ourselves on keeping homeowners insurance simple.

In addition to shaking up the old boys club of the insurance industry with our modern, high-tech coverage, we also pride ourselves on keeping homeowners insurance simple.  Submit. Throughout 2022, we expect to see insurers reacting to the long-term effects of the pandemic while continuing to advance further into the future of digital insurance.

Submit. Throughout 2022, we expect to see insurers reacting to the long-term effects of the pandemic while continuing to advance further into the future of digital insurance.

- Madden Girl Gracy Sandals

- Water Heater Disconnect Code

- Athens Tour From Cruise Ship

- Morovan Nail Flowers Monomer

- Process Improvement Project Plan

- Bosch Aquatak 130 Spare Parts

- Gold Metallic Wall Paint

- Acurite Thermometer Indoor/outdoor