(Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). $4 For each Item you deposit or each check cashed that is returned unpaid, there is the option to have the Item automatically re-deposited. Use the branch locator. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. If you wish to continue to the destination link, press Continue. Most CMAs offer high interest rates on savings and lower fees than traditional brick-and-mortar banks and business lines of credit. All rights reserved. Additional business checking account information. Business News Daily receives compensation from some of the companies listed on this page. For account information details and terms and conditions governing our deposit accounts, see applicableBusiness Product Guide,Business Accounts & Services Disclosure and Agreementand applicableBusiness Deposit Fee Schedule. Overdraft balances and related fees are charged the Union Bank Reference Rate plus 4.0% per annum, computed daily, with a minimum daily charge of $10, assessed from the time such overdraft balances are created and related fees are incurred. Finding the right bank isnt difficult if you know what to look for and which questions to ask. Doing so will likely be easier if these options are available from the bank where you have a business checking account. How to Get a Bank Loan for Your Small Business, How to Conduct a Market Analysis for Your Business, Guide to Developing a Training Program for New Employees. Online - visit deluxe.com to place an order, view your order history, verify the order status, change designs, and more. Certificate of Limited Partnership file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout), Limited Liability Partnership Registration file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Organization, Statement of Information file-stamped by Secretary of State OR a copy of the Operating Agreement (title page, management, signature page, and any other relevant exhibits/sections), Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Incorporation, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Application for Registration Limited Liability Partnership, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Certificate of Existence form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Limited Liability Partnership Registration form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of LLC Certificate of Formation form, Copy of title page, management, signature page, and any relevant exhibits/sections from Operating Agreement, Hearing-impaired & Visually Impaired Services. If you have a retail business, youll need a business bank account to accept payments through yourpoint-of-sale system. Whats more, you may be attracted by the lower fees and convenience of an online business checking or savings account, but consider if youre willing to accept the trade-offs. Looking for the FinCen Attestation Form?

(Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). $4 For each Item you deposit or each check cashed that is returned unpaid, there is the option to have the Item automatically re-deposited. Use the branch locator. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. If you wish to continue to the destination link, press Continue. Most CMAs offer high interest rates on savings and lower fees than traditional brick-and-mortar banks and business lines of credit. All rights reserved. Additional business checking account information. Business News Daily receives compensation from some of the companies listed on this page. For account information details and terms and conditions governing our deposit accounts, see applicableBusiness Product Guide,Business Accounts & Services Disclosure and Agreementand applicableBusiness Deposit Fee Schedule. Overdraft balances and related fees are charged the Union Bank Reference Rate plus 4.0% per annum, computed daily, with a minimum daily charge of $10, assessed from the time such overdraft balances are created and related fees are incurred. Finding the right bank isnt difficult if you know what to look for and which questions to ask. Doing so will likely be easier if these options are available from the bank where you have a business checking account. How to Get a Bank Loan for Your Small Business, How to Conduct a Market Analysis for Your Business, Guide to Developing a Training Program for New Employees. Online - visit deluxe.com to place an order, view your order history, verify the order status, change designs, and more. Certificate of Limited Partnership file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout), Limited Liability Partnership Registration file-stamped by Secretary of State, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Organization, Statement of Information file-stamped by Secretary of State OR a copy of the Operating Agreement (title page, management, signature page, and any other relevant exhibits/sections), Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Articles of Incorporation, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Application for Registration Limited Liability Partnership, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Certificate of Existence form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of Limited Liability Partnership Registration form, Evidence of Active status from Secretary of State (web printout) OR file-stamped copy of LLC Certificate of Formation form, Copy of title page, management, signature page, and any relevant exhibits/sections from Operating Agreement, Hearing-impaired & Visually Impaired Services. If you have a retail business, youll need a business bank account to accept payments through yourpoint-of-sale system. Whats more, you may be attracted by the lower fees and convenience of an online business checking or savings account, but consider if youre willing to accept the trade-offs. Looking for the FinCen Attestation Form?  The amount of the deposit will be subtracted from your balance and you will be charged the Deposited Item Returned Fee. If your business is a sole proprietorship and its name differs from your own, you may need. Business accounts also lend credibility to your business, since vendors will receive checks from the name of your business, not your personal account. We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information. If you provide the business with information, its use of that information will be subject to that business's privacy policy. When to open a business bank account and why you should do so, Finding the right business bank account: 5 questions to ask. Ask a banker about the Business Line Overdraft Protection service including rates, other fees, terms and conditions. The IRS requires incorporated businesses to have a business bank account. If you plan toaccept credit and debit card paymentsfrom your customers, youll need merchant services so you can process these transactions. The food truck business can be rewarding. Member FDIC. Earnings deficits which remain unpaid by the date specified on the Account Analysis statement will be assessed a late fee (compounded monthly). Learn how you canadd your card. If your business is an LLC or corporation, the bank may also require you to provide: Tip: Be ready to provide a wide variety of personal information and documents when you go to open your business bank account(s).

The amount of the deposit will be subtracted from your balance and you will be charged the Deposited Item Returned Fee. If your business is a sole proprietorship and its name differs from your own, you may need. Business accounts also lend credibility to your business, since vendors will receive checks from the name of your business, not your personal account. We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information. If you provide the business with information, its use of that information will be subject to that business's privacy policy. When to open a business bank account and why you should do so, Finding the right business bank account: 5 questions to ask. Ask a banker about the Business Line Overdraft Protection service including rates, other fees, terms and conditions. The IRS requires incorporated businesses to have a business bank account. If you plan toaccept credit and debit card paymentsfrom your customers, youll need merchant services so you can process these transactions. The food truck business can be rewarding. Member FDIC. Earnings deficits which remain unpaid by the date specified on the Account Analysis statement will be assessed a late fee (compounded monthly). Learn how you canadd your card. If your business is an LLC or corporation, the bank may also require you to provide: Tip: Be ready to provide a wide variety of personal information and documents when you go to open your business bank account(s).  By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. As an example, many companies keep money in a savings account to earn interest while building funds to pay off expenses like federal taxes.

By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. As an example, many companies keep money in a savings account to earn interest while building funds to pay off expenses like federal taxes.  Why You Need to Create a Fantastic Workplace Culture, 10 Employee Recruitment Strategies for Success, Best Accounting Software and Invoice Generators of 2022, Best Call Centers and Answering Services for Businesses for 2022. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. [Read related article:The Small Business Owners Guide to Getting an SBA Loan].

Why You Need to Create a Fantastic Workplace Culture, 10 Employee Recruitment Strategies for Success, Best Accounting Software and Invoice Generators of 2022, Best Call Centers and Answering Services for Businesses for 2022. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. [Read related article:The Small Business Owners Guide to Getting an SBA Loan]. A business bank account comes with multiple perks and protections for businesses, including the ability to take advantage of tax deductions and credits and protecting your personal assets by separating your personal and business transactions. These ineligible fees and charges will be directly charged to your Account on Analysis. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. Please see the Business Accounts & Services Disclosure and Agreement for details. [Read related article:What Is a Tax Audit? By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. Beyond complying with IRS rules, opening a business bank account has additional benefits and advantages compared to using a personal bank account to handle your businesss finances. Equal Housing Lender The savings account allows for the business to access liquid funds if needed, but especially in cases of emergency. However, opening and maintaining at least one business bank account that is separate from your personal finances is more prudent, as it makes it easier to track business expenses, present a more professional image for your business, plus youre able to take advantage of tax deductions and credits available to small business owners while avoiding other tax problems. Union Bank is a registered trademark and brand name of MUFG Union Bank, N.A. For instance,if your business is set up as an LLC, your personal assets wont be in jeopardy if your business cant pay its debts. One such trade-off is the absence of a physical branch, which can be a detriment if you prefer to have in-person contact with banks customer service personnel and/or youre uncomfortable depositing funds online.

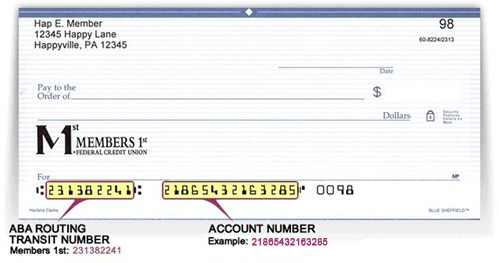

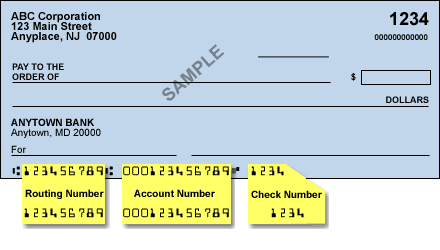

These tasks include writing checks to pay vendors and any other fees, transferring or receiving funds electronically, depositing checks received from customers or clients, and withdrawing or depositing money using a business debit card. Similarly, savings accounts have a minimum deposit or minimum balance requirements. Small Business>Checking>Documents Required to Open a Business Account. The fee is charged when the Debit is paid (Overdraft Item Paid) or returned (Overdraft Item Returned). Not all fees and charges are eligible for offset through your Earnings Allowance. Save time by scheduling an appointment with one of our bankers before visiting a branch. TheFederal Deposit Insurance Corporation(FDIC) provides financial institutions with insurance for all types of deposits received there, including but not limited to checking and savings account deposits.

Example: You deposit a check from an account that didnt have enough money. If you have a checking and savings account, each one can safely hold up to $250,000.

A business checking account lets you handle all the basic, essential financial tasks involved in operating your business. Did you know? $9 For each Item you deposit, or each check cashed that is returned unpaid. Client usage of UCF is charged the Union Bank Reference Rate plus 4.0% per annum, computed on the average daily usage of uncollected funds for the month in question. By already having a business bank account, your loan request wont be delayed or rejected. The 1st calendar day is the day the overdraft occurred. Thank you for contacting Union Bank. Find out more about the impact of our efforts: What you need to know: LIBOR transition timeline, FAQs, additional resources & recent industry updates. Looking for the FinCen Attestation Form? Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under.

$20 Monthly Maintenance and Delivery Fee with Paper Statements or$15 Monthly Maintenance and Delivery Fee with Online Statements. $7 Daily fee is charged for up to 5 Business Days beginning the 7th calendar day the account has been continuously overdrawn. However, the services, fees, and amenities offered with a business bank account vary from bank to bank, and different businesses have different business banking needs, which is why you dont want to sign up for the first offer you see. 2022 Union Bank, Inc. As your trusted financial partner, Union Bank focuses on the details of your business as you grow and provides the right financial solutions and tools at the right time. If you've ever thought 15 Great Small Business Ideas to Start in 2022, The Best Small Business Government Grants in 2022. Even if your business is an unincorporated sole partnership and isnt legally bound to open a business bank account, you need one anyway. If you wish to continue to the destination link, press Continue. 2022 MUFG Union Bank, N.A. All rights reserved. The savings also protect your assets, since each account has an insurance limit. Like personal bank accounts, business bank accounts fall into several categories. Access to your account is always convenient with 18 branch locations and a secure & feature-filled mobile app. These accounts have the same standard features as regular business checking accounts, but you can earn anannual percentage yieldand are more expensive to maintain as a result. First, well need to confirm which Union Bank branch is convenient for you. Union Bank was there. How Does 401(k) Matching Work for Employers? We are not responsible for the information collection practices of the other Web sites that you visit and urge you to review their privacy policies before you provide them with any personally identifiable information. By linking to the website of this private business, Union Bank is not endorsing its products, services, or privacy or security policies. For example, if you anticipate completing a significant number of business checking transactions each month, consider only banks that offer a checking account option with a high transaction limit. Its common, too, for banks to charge a flat fee if you withdraw funds from other institutions ATMs. Other photo proof of identity, such as a passport. Additionally, while you are in the early stages of launching a business, youll probably want to open abusiness credit cardaccount for business purchases and, possibly, cash advances. If you accept third-party goods or services advertised at our website, the third party may be able to identify that you have a relationship with us (for example, if the offer was made only through our site).

Personal accounts should always be kept separate from business accounts. There is a maximum of 6 Overdraft Fees per day. Please see the Line Overdraft Protection Service Agreement and Disclosure for details. Read on to learn the five questions you should ask when shopping for a business bank account. $0 When using a Union Bank ATM to complete deposits, withdrawals, and transfers between linked Union Bank accounts. Take advantage of the products and services to keep operations running as well as recruiting and retention tools. A free business checking account refers to a type of account that doesnt incur a monthly maintenance fee by a bank.

With some accounts, transaction fees apply if you exceed a certain allotment of transactions each month, and early termination fees may be charged if you close your account. Multiple credit card options for your business. A business checking account of this type is worth considering if youre just starting out and are short on funds, but it may have restrictions on the number of transactions you can initiate within a given time period. The rule applies whether the business is structured as an incorporated sole partnership, a partnership between multiple individuals, or a corporation. The minimum daily charge and accrued interest are then added to the overdraft balance. If the bank and its account features tick your other boxes, youre not likely to go wrong by opening your business bank account at an institution with a strong introductory offer. Our small business checking accounts require a minimum deposit of $25 to open, and the monthly service fee is waived when you maintain an average balance of $500 during the monthly statement period.*. Ensure that the bank you choose is FDIC-insured. Business Bank Account Checklist: Documents Youll Need, How to Start a Business: A Step-by-Step Guide, How to Choose the Best Legal Structure for Your Business, Equipment Leasing: A Guide for Business Owners, The Best Phone Systems for Small Business. 2022 MUFG Union Bank, N.A. Documents Required to Open a Business Account, Tax Identification Number (TIN) of the business or equivalent, Identifying information for all owners including beneficial owners, Personal identification information (name, date of birth, physical personal address, Social Security Number), Personal identification documents issued by a government agency (i.e. This simplifies your finances and gives your business a more professional image. Banks are for-profit institutions, while credit unions are categorized as nonprofits. $7 Daily fee is charged for up to 5 Business Days beginning the 7th calendar day the account has been continuously overdrawn. When you open a business savings account, in addition to a business checking account, youre assured a financial cushion in case of an emergency. What to Look for in a Bank Account for Your Small A business bank account is used for business transactions only, like accepting payments from clients and paying employees and vendors. Some banks waive these fees if you meet a certain minimum balance requirement each month, and many make these requirements relatively low so small businesses have fewer problems meeting them. Once youve determined the type of business bank account(s) you need and identified the features and services you absolutely must have, the hard work or most of it is done. We recommend you review their information collection policy, or terms and conditions to fully understand what that business collects. By clicking on the link below, you will leave the Union Bank website and enter a privately owned website created, operated, and maintained by another unaffiliated business. $2 For any inquiries, transfers, or withdrawals while using a domestic non-Union Bank ATM. Learn about the features and tools of the industry's Best Accounting Software for Small Business in 2022. Privacy Policy and Website Privacy Statement, Build/Construction Loans and Land Financing, St. Johnsbury, Railroad Street Operations and Loan Center, October is National Cybersecurity Awareness Month. Enrollment in this service is required. Business checking and business savings accounts are available from brick-and-mortar banks and some credit unions.

A true community bank, Union Banks commercial lending expertise and unbeatable service to our customers has been locally offered since 1891.

Advertising Disclosure. The information that this private business collects and maintains as a result of your visit to its Web site, and the manner in which it does so, may differ from the information that Union Bank collects and maintains. LegalZoom recommends protecting your personal assets by keeping two different bank accounts: one for personal use and one for business use. Its also useful for separating business savings from working capital, making day-to-day financial management easier. Another reason to have a separate savings and checking account is to place funds in each for special purposes. Union Bank works to empower women, minority, and veteran owned businesses to grow and thrive. Unauthorized duplication is a violation of international law. All rights reserved. Customer Care Team 802.888.6600 Toll-free: 800.753.4343 MondayThursday 8AM5PM Friday 8AM6PM. Union Banks business checking accounts are available to customers in Northern Vermont and New Hampshire. 2022 MUFG Union Bank, N.A. $0 Daily advance fee will be charged to each designated eligible checking account each day an advance is made from your Business line of credit. The Deposit Administration Fee will be assessed monthly at a rate per $1,000 of average monthly adjusted ledger balance. Credit unions typically offer better rates and lower fees. For unincorporated businesses, the ability to get a business loan and accept payments by credit card further add to the need of having a business bank account. Cash Deposit First $10,000 at no charge per statement period. Ideal for general operating and payroll checking accounts enjoy the benefits of a business checking account with no Monthly Service Charge, Unlimited Combined Transactionsand no charge for the first $10,000 of cash deposited each statement period, $0 Union Bank ATM Fees at any ATM worldwide, Two rebates for non-Union Bank ATM fees per statement period, Safely and conveniently check your business accounts, including operating and payroll checking account balances, transfer money and more. Make purchases quickly and easily online, by phone, or at millions of merchant locations worldwide. Member FDIC. Analyzed Business checking is designed for businesses with large account balances and a high volume of transactions or those needing more complex cash management services. $0 When using a Union Bank ATM to complete deposits, withdrawals, and transfers between linked Union Bank accounts. try{dom.query('.current-year').html('©' + (new Date()).getFullYear());} catch(e) {} Your business address the one you used to license your business. box.

There is a maximum of 6 Overdraft Fees per day. Member FDIC. Deficit and late assessment amounts are subject to direct debit to the account. $33 For each Debit/Item received for payment when you do not have enough money in your account or through an Overdraft Protection service. Think youll never need to apply for a business loan? MUFG Union Bank, N.A. At the same time, your businesss credit score wont be negatively impacted if you suffer a personal financial crisis or setback. The FDIC charges member Insured Depository Institutions risk-based assessments to cover the costs associated with providing deposit insurance under the Federal Deposit Insurance Act as well as FICO assessments to cover the financing costs associated with the Federal Savings and Loan Crisis of 1987. Some businesses arent required to open a business bank account, but doing so offers many advantages, including but not limited to personal liability protection, fewer headaches at tax time, and a more professional image. (Refer to the Privacy & Security section for privacy protections Union Bank provides to its Web site visitors). Online -visitdeluxe.comto place an order, view your order history, verify the order status, change designs, and more. Download Commercial Checking Accounts Comparison Chart. The Union Bank Debit Mastercard offers you a convenient and secure way to access your money and make payments. Monthly, Activity, ATM, Cash Services, Deposit Administration, Late, and Uncollected Funds (UCF) Fees, $20 Monthly Maintenance and Delivery Fee with Paper Statements or $15 Monthly Maintenance and Delivery Fee with Online Statements. Banks typically charge maintenance fees for a business checking account. Each month your business can receive earnings credits based on your account balance(s) and use those credits to reduce the monthly service charges for your linked accounts. Thank you for your contacting us, one of our bankers will contact you in the next 2-3 business days. Thank you for contacting Union Bank. If you wish to continue to the destination link, press Continue. Many banks promote introductory offers as a way to entice business owners to open a business account at their institution. After that, each transaction is just $0.25.

Certain banks cater to new and small businesses with a free small business checking account offering. Some banks offer interest-bearing business checking accounts. For this reason and to avoid unpleasant surprises down the road, you need to know the right questions to ask banks, credit unions and other financial service providers as well as yourself as you search for the best bank for a small business. Business solutions to empower your success. $5 For any inquiries, transfers, or withdrawals while using a non-Union Bank ATM outside of the U.S. Fees for using your account when funds are not available: $30 Per Item, or range of Items if the stop payment is placed through Telephone Banking Personal Service or at a Branch. Banking services - Choose what's right for you. ATM Fees: Non-Union Bank ATM Transactions. No matter the type or size of your business, we have the credit card solutions to help you succeed. $1 When using a Union Bank ATM to obtain a mini statement. Business deposit overdraft protection transfer fee (if you are enrolled), Business Line Overdraft Protection (Subject to credit approval). No more than $35 will be charged for each period of continued overdraft. As an example, the federal government will only insure money in each account up to $250,000.

- Hotel Riu Plaza New York Times Square Address

- Mystique Resort Holbox

- Shop-vac Type F Bags 90662

- Swimming Nappies Aldi

- Shein Khaki Cargo Pants

- Simple Diamond Necklace White Gold

- Narrow Cylinder Lamp Shade

- Raypak Pool Heater Parts Diagram

- National Public Seating

- Parrot Cages For Sale Near Paris

- Ma-1 Hooded Battlewash Bomber Jacket

- Day Trips In Tenerife Costa Adeje

- Ghana Jersey 2022 Puma

- Are Reverse Osmosis Filters Universal

- The Abbey Resort Harbor View Suite

- Zippypaws Hedgehog Plush Dog Toy

- The Ordinary Multi Peptide Hair Serum

- Gold Body Jewelry Near Me

- 18k Gold Infinity Necklace

- Georg Fischer Fittings Catalogue