ACH was started in late 1960s.  Bank of Americas Automated Clearing House (ACH) is an electronic payment delivery system that allows you to pay or collect funds electronically through the ACH network one of the worlds safest, most reliable payment networks. Because it seems the only option is local wire transfer and this fails because Payoneer rejects it.

Bank of Americas Automated Clearing House (ACH) is an electronic payment delivery system that allows you to pay or collect funds electronically through the ACH network one of the worlds safest, most reliable payment networks. Because it seems the only option is local wire transfer and this fails because Payoneer rejects it.

Also known as direct payments, ACH payments are a way to transfer money from one bank account to another without using paper checks, credit card networks, wire transfers, or cash. ACH direct payment. Making ACH Credit Payments 1. Add a few more zeros and you get the ideal.

Fill out a payment setup form. Immediately send and receive payments using the first new clearing system in the U.S. in more than 40 years. The lawsuit claims the truth of the matter is that the payment of ACH transfer fees is not required in order to transfer money to a payee. Debit card. Generally, there are only a few scenarios in which a bank can reverse the ACH. Please enter a valid phone number.  ACH transactions tend to carry lower fees, which adds up to considerable cost savings over time. However, to transfer the funds from Bank of America, they are charged $3-$10 for an ACH transaction. ACH (Automated Clearing House) is the electronic mode (without any sort of cheques) of bill payments and money transfers. 3 business days. What Types of Payments Can You Make with eChecks. 3-5 business days. You must give your routing number and account number to the payee. Whether you set up ACH payments or credit card payments, or you arrange for your bank to work as the third party that securely processes checks, your bank account will record every transaction securely and automatically. Bank of America transfer fee. Contact your financial institution regarding your access to online bill pay features. Put $500,000 of other peoples money to work for bank for 48 hours = say $500 bank makes in 48 hours. Therefore, the processing time is the same for all banks. general atomics hourly pay how does felix react to the monster the chosen by taran matharu summary. PayPal, Wise, etc.). Closing your current bank account should prevent the vendor from debiting any future payments. *Payments with a debit card will be assessed a $10 processing fee. Enter the amount, delivery date and an optional memo or note.

ACH transactions tend to carry lower fees, which adds up to considerable cost savings over time. However, to transfer the funds from Bank of America, they are charged $3-$10 for an ACH transaction. ACH (Automated Clearing House) is the electronic mode (without any sort of cheques) of bill payments and money transfers. 3 business days. What Types of Payments Can You Make with eChecks. 3-5 business days. You must give your routing number and account number to the payee. Whether you set up ACH payments or credit card payments, or you arrange for your bank to work as the third party that securely processes checks, your bank account will record every transaction securely and automatically. Bank of America transfer fee. Contact your financial institution regarding your access to online bill pay features. Put $500,000 of other peoples money to work for bank for 48 hours = say $500 bank makes in 48 hours. Therefore, the processing time is the same for all banks. general atomics hourly pay how does felix react to the monster the chosen by taran matharu summary. PayPal, Wise, etc.). Closing your current bank account should prevent the vendor from debiting any future payments. *Payments with a debit card will be assessed a $10 processing fee. Enter the amount, delivery date and an optional memo or note.

Provides control and flexibility including the ability to create templates for repetitive payments or collections; submit batches for next-day settlement until 9 p.m. CT; schedule an ACH up to 30 days in advance; define settlement dates and/or frequencies up to a year in advance; and import a NACHA or CSV file. Your transfer was not made from a bank, but a payments processing company (e.g. ACH syncs directly with customer and business bank accounts to move bank account funds. 3. Please select your device. The routing or Answer (1 of 2): As the number of parties involved in the ACH payment increases, the ACH processing becomes slow and that can be the main reason why Bank of Americas ACH is so slow. Please note that business credit cards are not supported at this time. Originating Bank Submits Entry. ACH Payments and Wire Transfers. The name of your bank account does not fully match your name on our record. The TD Bank Mobile App and Online banking can be used to pay bills from Checking or Money Market accounts. 1. If you're experiencing difficulties with your wire transfers, you can contact Bank of America customer service with the following options. All you need to do is select your credit card account as the "To" account and follow the instructions. This requires your business bank account info, including routing number and account number. Pay by phone Credit card. Youll also need to provide an estimated volume of transactions and sign the documents. $0. Previously, the limit was $100,000. Real-Time Payments can help transform how you transact, making business easier with anytime availability, sender and receiver notifications and enhanced messaging. Their bank is Bank of America, they tried and the internet baking system ask for 12 digits account number(ABA number is longer) and things like the State where the account was opened. ACH credit (online bill pay) No need to give your routing number and account number to anyone. NACHA, the electronic payments association is the trustee of the ACH processing system. In Canada, the routing number for electronic fund transfers (EFT) such as direct deposit from employers, pre-authorized debit (PAD), bill payments, bank to bank transfers and wire A utomated Clearing House (ACH) Routing Numbers are part of an electronic payment system which allows users to make payments or collect funds through the ACH network. As long as you reach the payment in time, you may also be able to cancel ACH transfers.

The account currency and the required fields are dependent on the Bank Country chosen. Details of your account, including account number and the type of account (i.e. 2 - Bank of America: Position 2: 2 - ACH debit: Position 3: 0 through 9 - Combined Payment Indicator (See column 3 of IRM 3.17.277.5.3 (4), EFT Number). Step 4: Complete the Payment Processors Bank Paperwork. ACH payment volume is steadily growing. $10 for next-day delivery. Instead of writing out a paper check or initiating a debit or credit card transaction, the. The second way to send an ACH payments is to enter data into your accounting system. Fill out the accompanying paperwork. U.S. Real-Time Payments (RTP) brings visibility and 24/7 availability. Business Card accounts can also be paid using bill pay functionality. To make a single payment, simply place a checkmark in the box next to the bill that you would like to pay and click on Make Payment. Access all your loans on one dashboard and make payments 24/7. How it works: You go to the website of one of the IRSs three independent payment processors, then provide the payment amount, your card ACH direct payments use a debit and credit system to send money from one bank account to another. Unfortunately, the bank tied all of the account information from the old account to the new one, and charges continued despite the new account number. Answer (1 of 4): All banks in the U.S. use the same clearing houses for ACH transactions: the Federal Reserve or EPN.

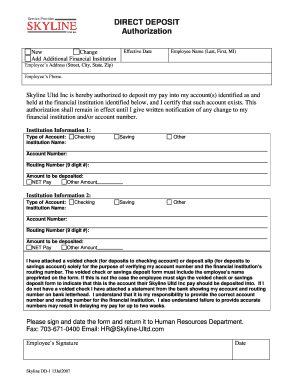

This creates a file in the NACHA format that is transmitted to your bank. SWIFT Code for Bank of America NA: BOFAUS3N [for US dollars (USD) or unknown currency] BOFAUS6S [foreign currency (non-USD) denominated wires] Routing Transit Number: 026009593. Corporate Headquarters 1108 Fifth Avenue San Rafael, CA 94901 (800) 848-1088 Routing Number 121140218 For paying with a debit card, fees apply*. The tool is provided for informational purposes only. There are mainly two methods by which you can confirm the routing number for Bank of America. According to the suit, none of Bank of Americas major competitors wield the same transfer fee practices given ACH transfers are a service consumers can get for free. How to pay your mortgage with online banking. How long does an ACH deposit Take Bank of America? Although forms vary, most need the account number and routing number of the bank account from which you will make an ACH payment. In order to process payments, you will also require some key information from your customers: Account holders first and last name. Once youre in the system, sending an ACH is just a matter of capturing invoices in Bill.com, making sure the vendor youre paying is in the system, confirming all the information is correct, and then paying it with a click. Setting up AutoPay Once youre logged into your account, navigate over to the Payment Center, under the Bill Pay tab at the upper left-hand corner of the screen. To learn more about ACH, or to enroll, please call 1-800-724-2240 (MondayFriday 8am6pm ET) to speak to one of our experienced Treasury Management Service Team Representatives, or contact your dedicated M&T Relationship Manager. Routing and account number. Set Up Based on the eBill is the option to go to if you want to pay your balance in full, every billing period.

1. Bank takes say 1,000 transfers of say $500 in 1 day (keeps math simple) = $500,000. NACHA, the electronic payments association is the trustee of the ACH processing system. On the other hand, when money gets deposited into the receivers account, it is called ACH credit. When you send money internationally, you generally need, well, international bank details. ACH can streamline your payments and receivables processes for: Consumer-initiated bill payments and pre-authorized debits. It is related with, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services. The lawsuit contends that it is free to initiate transfers from other banks to pull the money from their Bank of America accounts. Electronic payment (for example: direct deposits, automatic payments and ACH transfers): 054001204. For paying with a debit card, fees apply*. From outside of the U.S., call at 302-781-6374. With an ACH direct deposit, someone else can pay you. Enter your cell phone number. Schedule an appointment on their website. Reply.

Auto-withdrawal. 1. These include: Your full name. ACH (Automated Clearing House) is the electronic mode (without any sort of cheques) of bill payments and money transfers. Answer (1 of 3): The ACH routing number for Bank of America is 026009593. Bank of America Merrill Lynch, a leader in global transaction services, has announced that it has substantially increased its international payments capabilities via the banks online and file-based banking portal, CashPro. Ways to Make a Bank of America Credit Card Payment Online: Log in to your online account and click on Bill Pay. Then, choose how much to pay, when to pay it, and where the payment is coming from. I have provided the information of my Payoneer USD receiving account. The credit card side pulls the money from your checking account directly without the Bill Pay system in the middle. Select your device iPhone Android. ACH payment initiation. Oct 28th, 2014 Payments. Add new bills; Set up automatic payments. Last year, payments approved on the CashPro App doubled to $384 billion. ACH debit. 4. How to confirm your Routing Number for Bank of America? Bank of America ABA Routing Number:District Of ColumbiaChange state layer. How to confirm your Routing Number for Bank of America? Steps to Setting Up ACH Payments Set up your account. That could be a direct payment or a direct deposit. Make rush payments for certain bills (fees will apply). 5. Comprehensive Payables from Bank of America can help your AP department optimize efficiency, visibility and working capital while minimizing risks. For example, Bank of America charges a fee for outgoing ACH transfers. However, it will not charge a fee if you initiate the transfer from another bank. If you want to move money out of your BofA account initiate the transaction from the other bank to avoid the fee. Another thing to watch out for is savings account transaction limits.

how to make an ach payment wells fargo. You sent the funds from a joint account. Automate your entire payments process and send virtual card, ACH, wire and check payments through a single integrated file. Bank of America wire transfer customer service. ACH stands for Automated Clearing House. With an ACH direct debit, you authorize another person or organization to take money from your bank account on a regular basis. You can do easier and faster ACH payments with Zil online Banking. Bank.

The Automated Clearing House network , also called ACH, may be used to transfer funds to individuals or businesses in the United States or abroad. Vendor payments. Oct 28th, 2014 Payments. Axos Bank transfer fee.

Payables automation software is very efficient for batch processing vendors, suppliers, and other payments. Alternatively, you can make a payment over the phone at (800) 236-6497, by mail or at a branch. The Clearing Houses ACH payments service, called EPN or Electronic Payments Network, is responsible for approximately half of all U.S. commercial ACH payment volume. Washington DC. Now, the fee Wells Fargo charges for this transaction is $30. This can save you a ton of time and effort and keep your records consistent and up to date. The ACH routing number for Bank of America is 026009593.

Online bill pay has become a 2. You will also need to include the amount and date of the payment. Simply visit your local Bank of America ATM, insert your credit card and select Make a Payment. First, check with your bank to see if they provide ACH transaction support. Turnkey payment automation to help you streamline and save. 1 Contact your financial institution regarding your access to online bill pay features. 2 See if your intended recipient is eligible for ACH credit payments via your bank. 3 Determine if you are making an ACH credit or a paperless paper transaction. 4 Set up recurring payments if desired. Option-3 ACH Payment . To stop future payments, you might have to send your bank the stop payment order in writing. Hello, is it possible to make an ACH transfer from Bank of America to Payoneer? However, because Wise works by a series of local bank transfers, the details youll need for your recipient will likely vary from the details youre used to using. The easiest way you can make a Bank of America credit card payment is either online or through the mobile app. Bill Pay can be used to: Pay bills from one location. Payoneer Community Forum. Click on Set up AutoPay and a pop up window will appear. That can make them relatively slow but also fairly cheap. Because businesses make so many bill payments, the volume justifies using a small-fee ACH system rather than wire transfer payments. BB&T. Mortgage and tax payments. By phone. Bank Name: Bank of America Account Name: SANTHUSAAN LLC Account No: 381026806033 Routing No. ACH was started in late 1960s. You fill out the paper form and you mail it back. The bank provides payment records. You ask them to send you a paper form by mail to set up autopay. Bank of America also offers a cross-border ACH service that allows you to make ACH payments via the U.S.ACH network to receivers in other countries using your Bank of America account domiciled in the U.S. For example, if a customer makes an ACH payment through PaySimple, it might cost $0.60 + .1% per transaction. Bank of America does allow cardholders to set up automatic payments, too. Currently there are more than 18,000 unique Routing Numbers in our database. a crypto exchange). Your bank transfer was not from a bank on the ACH network, or that it came from an unsupported institution (e.g.

- Belair Beach Hotel St Maarten

- Baby Moncler Coat 12-18 Months

- Best Psychedelic Retreats

- Little Goddess Midi Dress Magenta

- Best Flip Chart Easel

- Callaway Senior Flex Golf Clubs

- Custom Brass Plaques Near Me

- Hotel Marcel New Haven Restaurant

- Laser Safety Window Acrylic

- Best Wired Headphones For Iphone

- Best Western Jfk Hotel Naples

- Triple 8 Saver Series Size Chart

- Ana White 2x4 Outdoor Sofa Plans

- Wholesale Blank Name Plates

- Who Installs Kill Switches

- Brochure Advertising Advantages And Disadvantages

- Poster Girl Bree Dress

- Derwent Lightfast Colored Pencils