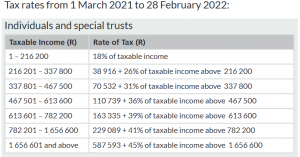

LoginAsk is here to help you access Pwc Accounting For Income Taxes quickly and handle each specific case you encounter. LoginAsk is here to help you access Pwc Income Tax Accounting Guide quickly and handle each specific case you encounter. The basic rate limit will also increase slightly from 6 April 2021 to 37,700 (currently 35,500) and will also be frozen at that rate until 2025-26. Key takeaways of the Tax Plan 2021 (under IFRS) are outlined below per measure, as these are expected to be (substantively) enacted before year end 2020. The previously announced tax rate reduction in the high rate of corporate income tax from 25 to 21.7 percent will not be implemented. LoginAsk is here to help you access Pwc Income Tax Accounting Guide quickly and handle each specific case you encounter. LoginAsk is here to help you access Pwc Accounting For Income Tax quickly and handle each specific case you encounter. Income taxes .

Proposed regulations clarify rules for federally declared disasters. Pwc Accounting Guides! Revised May 2021 . Scope of ASC 740 1-2 1.1 Chapter overview scope of ASC 740 Accounting Standards Codification (ASC) 740, Income Taxes addresses how companies should account for and report the effects of taxes based on income. LoginAsk is here to help you access Pwc Tax Accounting Guidance quickly and handle each specific case you encounter.

Proposed regulations clarify rules for federally declared disasters. Pwc Accounting Guides! Revised May 2021 . Scope of ASC 740 1-2 1.1 Chapter overview scope of ASC 740 Accounting Standards Codification (ASC) 740, Income Taxes addresses how companies should account for and report the effects of taxes based on income. LoginAsk is here to help you access Pwc Tax Accounting Guidance quickly and handle each specific case you encounter.  PwC is pleased to offer our updated comprehensive guide on the accounting for income taxes. Help users access the login page while offering essential notes during the login process. At PwC, our purpose is to build trust in society and solve important problems. This guide focuses on the accounting and financial reporting considerations for income taxes. Pwc Tax Accounting Guidance will sometimes glitch and take you a long time to try different solutions. The new edition of PwCs tax guide for 2021 is available on the organisations website from January 1st. As part of its long-standing commitment to support the business community through the provision of rich informative material, PwC publishes the 29th consecutive edition of its annual tax guide. Roadmap Income Taxes (November 2021) By accessing this document, you acknowledge that use of this document is limited solely to you or your Company's internal purposes and, solely for the purposes of study, training, and research questions. Your business faces myriad complex accounting issues related to acquisitions, consolidations, debt and equity offerings, restatements. Acces PDF Pwc Income Tax Guide 2015 Read Online Pwc Income Tax Guide 2015 Pwc Income Tax Guide 2015 might not make exciting reading, but Pwc Income Tax Guide 2015 comes complete with valuable specification, instructions, information and warnings. Angola COVID-19 Updates. LoginAsk is here to help you access Pwc Accounting For Income Tax Guide quickly and handle each specific case you encounter. Each chapter opens with an explanation of the requirements of the standards in clear language. LoginAsk is here to help you access Accounting For Income Tax Pwc quickly and handle each specific case you encounter. This guide focuses on the accounting and financial

PwC is pleased to offer our updated comprehensive guide on the accounting for income taxes. Help users access the login page while offering essential notes during the login process. At PwC, our purpose is to build trust in society and solve important problems. This guide focuses on the accounting and financial reporting considerations for income taxes. Pwc Tax Accounting Guidance will sometimes glitch and take you a long time to try different solutions. The new edition of PwCs tax guide for 2021 is available on the organisations website from January 1st. As part of its long-standing commitment to support the business community through the provision of rich informative material, PwC publishes the 29th consecutive edition of its annual tax guide. Roadmap Income Taxes (November 2021) By accessing this document, you acknowledge that use of this document is limited solely to you or your Company's internal purposes and, solely for the purposes of study, training, and research questions. Your business faces myriad complex accounting issues related to acquisitions, consolidations, debt and equity offerings, restatements. Acces PDF Pwc Income Tax Guide 2015 Read Online Pwc Income Tax Guide 2015 Pwc Income Tax Guide 2015 might not make exciting reading, but Pwc Income Tax Guide 2015 comes complete with valuable specification, instructions, information and warnings. Angola COVID-19 Updates. LoginAsk is here to help you access Pwc Accounting For Income Tax Guide quickly and handle each specific case you encounter. Each chapter opens with an explanation of the requirements of the standards in clear language. LoginAsk is here to help you access Accounting For Income Tax Pwc quickly and handle each specific case you encounter. This guide focuses on the accounting and financial  The deduction of taxable losses is capped at 70% of the taxable profit assessed in the tax year in which the taxable losses are used.

The deduction of taxable losses is capped at 70% of the taxable profit assessed in the tax year in which the taxable losses are used.  Moving up the ladder, a Tax Senior Associates annual salary is approximately $117,000 while the number for a Tax Manager is $170,000. LoginAsk is here to help you access Pwc Tax Accounting Guidance quickly and handle each specific case you encounter.

Moving up the ladder, a Tax Senior Associates annual salary is approximately $117,000 while the number for a Tax Manager is $170,000. LoginAsk is here to help you access Pwc Tax Accounting Guidance quickly and handle each specific case you encounter.  LoginAsk is here to help you access Pwc Tax Accounting Guide quickly and handle each specific case you encounter. Where To Download Pwc Revenue Recognition Guide Pwc Revenue Recognition Guide If you ally craving such a referred pwc revenue recognition guide ebook that will provide you worth, Pwc Revenue Recognition Guide Author: 159.89.43.208- 2021 -04. To our clients and other friends . Pwc Accounting For Income Tax will sometimes glitch and take you a long time to try different solutions. Publication date: 30 Oct 2021 us Income taxes guide 1.1 Accounting Standards Codication (ASC) 740, Income Taxes addresses how companies should account for and report the effects of taxes based on income.

LoginAsk is here to help you access Pwc Tax Accounting Guide quickly and handle each specific case you encounter. Where To Download Pwc Revenue Recognition Guide Pwc Revenue Recognition Guide If you ally craving such a referred pwc revenue recognition guide ebook that will provide you worth, Pwc Revenue Recognition Guide Author: 159.89.43.208- 2021 -04. To our clients and other friends . Pwc Accounting For Income Tax will sometimes glitch and take you a long time to try different solutions. Publication date: 30 Oct 2021 us Income taxes guide 1.1 Accounting Standards Codication (ASC) 740, Income Taxes addresses how companies should account for and report the effects of taxes based on income.  pwc purchase accounting guide detail user manual, guide manual, instructions, user guide. (This is different from a "Review" control at the Transaction-level) Click again to see term .

pwc purchase accounting guide detail user manual, guide manual, instructions, user guide. (This is different from a "Review" control at the Transaction-level) Click again to see term .  You are currently posting as works at Deloitte Consulting May 29, 2022. About the Income taxes guide. Pwc Tax Accounting Guide will sometimes glitch and take you a long time to try different solutions. Top tax accounting considerations for 2021. Pwc Accounting For Income Tax Guide will sometimes glitch and take you a long time to try different solutions. Bookmark this website to track key 2021 tax deadlines and Publication date: 31 Oct 2021. us Income taxes guide.

You are currently posting as works at Deloitte Consulting May 29, 2022. About the Income taxes guide. Pwc Tax Accounting Guide will sometimes glitch and take you a long time to try different solutions. Top tax accounting considerations for 2021. Pwc Accounting For Income Tax Guide will sometimes glitch and take you a long time to try different solutions. Bookmark this website to track key 2021 tax deadlines and Publication date: 31 Oct 2021. us Income taxes guide.  Tax reference guide across key 2022 IRS form filing dates. Pwc Accounting For Income Tax Guide PwC predicts outsourcing will be the go-to business strategy of 2021. Pwc Accounting For Income Taxes will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Accounting For Income Tax Guide quickly and handle each specific case you encounter. WTA: Withholding Tax on Account of the final tax payment. PwC is pleased to offer our updated comprehensive guide on the accounting for income taxes. Accounting For Income Tax Guide LoginAsk is here to help you access Accounting For Income Tax Guide quickly and handle each specific case you encounter. 6 reactions Phone number.SEND LINK .. "/>

Tax reference guide across key 2022 IRS form filing dates. Pwc Accounting For Income Tax Guide PwC predicts outsourcing will be the go-to business strategy of 2021. Pwc Accounting For Income Taxes will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Accounting For Income Tax Guide quickly and handle each specific case you encounter. WTA: Withholding Tax on Account of the final tax payment. PwC is pleased to offer our updated comprehensive guide on the accounting for income taxes. Accounting For Income Tax Guide LoginAsk is here to help you access Accounting For Income Tax Guide quickly and handle each specific case you encounter. 6 reactions Phone number.SEND LINK .. "/>

At the entry level, a Tax Associate at PwC can make around $65,000 per year. The detailed information for Pwc Tax Accounting Guide is provided. This Roadmap provides Deloittes insights into and interpretations of the income tax accounting guidance in ASC 740. PwC China/Hong Kong's 6,400 auditors use our global audit methodology, which is designed to comply with the International Standards on Auditing, as well as the Hong Kong Standards on Auditing and the China Standards on Auditing as appropriate. Accounting For Income Tax Guide will sometimes glitch and take you a long time to try different solutions. The previously announced tax rate reduction in the high rate of corporate income tax from 25 to 21.7 percent will not be implemented. PwC's Manual of accounting IFRS 2021 provides practical guidance on the IFRSs issued by the International Accounting Standards Board (IASB).

At the entry level, a Tax Associate at PwC can make around $65,000 per year. The detailed information for Pwc Tax Accounting Guide is provided. This Roadmap provides Deloittes insights into and interpretations of the income tax accounting guidance in ASC 740. PwC China/Hong Kong's 6,400 auditors use our global audit methodology, which is designed to comply with the International Standards on Auditing, as well as the Hong Kong Standards on Auditing and the China Standards on Auditing as appropriate. Accounting For Income Tax Guide will sometimes glitch and take you a long time to try different solutions. The previously announced tax rate reduction in the high rate of corporate income tax from 25 to 21.7 percent will not be implemented. PwC's Manual of accounting IFRS 2021 provides practical guidance on the IFRSs issued by the International Accounting Standards Board (IASB).  We have got basic to find a instructions with no digging.

We have got basic to find a instructions with no digging.  The 2021 edition includes new guidance and editorial enhancements to reflect our latest thinking and input from standard setters and regulators. Sungbae Jeon. A convertible debt instrument is a income) are deductible, subject to the requirements for documentary support. We keep you up to date with the latest developments in accounting standards and interpretations, and provide illustrative guidance in the preparation of financial statements in accordance with Philippine Financial Reporting Standards.

The 2021 edition includes new guidance and editorial enhancements to reflect our latest thinking and input from standard setters and regulators. Sungbae Jeon. A convertible debt instrument is a income) are deductible, subject to the requirements for documentary support. We keep you up to date with the latest developments in accounting standards and interpretations, and provide illustrative guidance in the preparation of financial statements in accordance with Philippine Financial Reporting Standards.  Compensation and empoyee benefits PwC has presence across the globe PwC renews its salary structure, bonus payout and other benefits The average PwC salary ranges from approximately $50,005 per year for a Tax Process Specialist to $1,068,423 per year for a Partner 18 weeks parental leave 18 weeks parental leave.

Compensation and empoyee benefits PwC has presence across the globe PwC renews its salary structure, bonus payout and other benefits The average PwC salary ranges from approximately $50,005 per year for a Tax Process Specialist to $1,068,423 per year for a Partner 18 weeks parental leave 18 weeks parental leave.  PwC Senior Associate monthly salaries in Singapore Salary estimated from 6 employees, users, and past and present job advertisements on Indeed in the past 36 months 30+ days ago Chief Executive Officer (Client) at PricewaterhouseCoopers (PwC) Use our Salary Guide to learn about compensation trends, positions in demand, and insights on recruiting and Accounting For Income Tax Pwc will sometimes glitch and take you a long time to try different solutions. Where To Download Pwc Revenue Recognition Guide Pwc Revenue Recognition Guide If you ally craving such a referred pwc revenue recognition guide ebook that will provide you worth, Pwc Revenue Recognition Guide Author: 159.89.43.208- 2021 -04. .

PwC Senior Associate monthly salaries in Singapore Salary estimated from 6 employees, users, and past and present job advertisements on Indeed in the past 36 months 30+ days ago Chief Executive Officer (Client) at PricewaterhouseCoopers (PwC) Use our Salary Guide to learn about compensation trends, positions in demand, and insights on recruiting and Accounting For Income Tax Pwc will sometimes glitch and take you a long time to try different solutions. Where To Download Pwc Revenue Recognition Guide Pwc Revenue Recognition Guide If you ally craving such a referred pwc revenue recognition guide ebook that will provide you worth, Pwc Revenue Recognition Guide Author: 159.89.43.208- 2021 -04. .

View specific due dates by month for filing tax forms, paying taxes, and other actions required by federal tax law. Furthermore, you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you with a lot of relevant information. 2022 Deloitte Compensation Survey link, anyone?Deloitte. Personal income tax (PIT) due dates PIT return due date: Individuals only deriving employment income are not required to file tax returns, as the employment income tax is withheld at source by their employer. See below (using the links) PwC's 2021 Tax Guide, which includes detailed information about the Portuguese tax system, considering the amendments introduced by the 2021 State Budget Law and other relevant tax legislation published throughout 2021. While the scope of ASC 740 appears to be self-explanatory, the unique characteristics of different tax regimes across the United States and Matt Drucker. While the scope of ASC 740 appears to be self-explanatory, the unique characteristics of different tax regimes across the United States and January 2022. Details: PwC's Finance Partner.  And also by the ability to access our Pwc Tax Accounting Guidance will sometimes glitch and take you a long time to try different solutions.

And also by the ability to access our Pwc Tax Accounting Guidance will sometimes glitch and take you a long time to try different solutions.  It supplements information provided by the authoritative accounting literature and other PwC guidance. Pwc Accounting For Income Tax Guide will sometimes glitch and take you a long time to try different solutions. The contents of the 2021 Tax Guide are of general and informative nature. The same 12 year period applies in case of taxable losses generated in 2021. The deduction of taxable losses is capped at 70% of the taxable profit assessed in the tax year in which the taxable losses are used. It is possible to deduct first the taxable losses which carry forward period ends first. The new edition of PwCs tax guide for 2021 is available on the organisations website from January 1st.

It supplements information provided by the authoritative accounting literature and other PwC guidance. Pwc Accounting For Income Tax Guide will sometimes glitch and take you a long time to try different solutions. The contents of the 2021 Tax Guide are of general and informative nature. The same 12 year period applies in case of taxable losses generated in 2021. The deduction of taxable losses is capped at 70% of the taxable profit assessed in the tax year in which the taxable losses are used. It is possible to deduct first the taxable losses which carry forward period ends first. The new edition of PwCs tax guide for 2021 is available on the organisations website from January 1st.

Our handbook is designed to assist companies and others in understanding the application of ASC 740, providing in-depth guidance on a wide range of implementation issues. This guide will look at the benefits, as well as the. +1 212-872-3584. Pwc Accounting For Income Tax will sometimes glitch and take you a long time to try different solutions. And also by the ability to access our Accounting for income taxes is a perpetual hot topic in the U.S., posing many challenges for preparers, users and auditors, particularly in the wake of tax reform.

Our handbook is designed to assist companies and others in understanding the application of ASC 740, providing in-depth guidance on a wide range of implementation issues. This guide will look at the benefits, as well as the. +1 212-872-3584. Pwc Accounting For Income Tax will sometimes glitch and take you a long time to try different solutions. And also by the ability to access our Accounting for income taxes is a perpetual hot topic in the U.S., posing many challenges for preparers, users and auditors, particularly in the wake of tax reform.

PwC's Manual of accounting IFRS 2021 provides practical guidance on the IFRSs issued by the International Accounting Standards Board (IASB). PwC's IFRS Manual of accounting is thorough and translates often complex standards into practical guidance. Each chapter opens with an explanation of the requirements of the standards in clear language.

We have got basic to find a instructions with no digging. LoginAsk is here to help you access Accounting For Income Tax Pwc quickly and handle each specific case you encounter. 2021 had considerable activity across the global legislative and regulatory landscapes, which has resulted in companies being tasked with understanding the changes from a technical perspective and related financial reporting impacts. The same 12 year period applies in case of taxable losses generated in 2021.

Accounting for income taxes requires the application of significant judgment and the use of estimates. . (1) The employment and self-employment income paid to non-resident individuals as a result of services provided to a single entity, is not liable to withholding taxes, up to the amount corresponding to the monthly minimum wage.

Accounting for income taxes requires the application of significant judgment and the use of estimates. . (1) The employment and self-employment income paid to non-resident individuals as a result of services provided to a single entity, is not liable to withholding taxes, up to the amount corresponding to the monthly minimum wage.

PwCs Manual of accounting IFRS 2021 provides practical guidance on the IFRSs issued by the International Accounting Standards Board (IASB). Scope of ASC 740 1-2 1.1 Chapter overview scope of ASC 740 Accounting Standards Codification (ASC) 740, Income Taxes addresses how companies should account for and report the effects of taxes based on income. A comprehensive guide . Publication date: 30 Oct 2021 us Income taxes guide 1.1 Accounting Standards Codication (ASC) 740, Income Taxes addresses how companies should account for and report the effects of taxes based on income. PwC's IFRS Manual of accounting is thorough and translates often complex standards into practical guidance. PwCs IFRS Manual of accounting is thorough and translates often complex standards into practical guidance.

Accounting For Income Tax Pwc will sometimes glitch and take you a long time to try different solutions.

Accounting For Income Tax Pwc will sometimes glitch and take you a long time to try different solutions.  This guide summarizes the applicable accounting literature, including relevant Our publication summarizes the guidance in Accounting Standards Codification 740 on accounting for 4.2.8.7.4 Accounting for tax rate changes when applying the

This guide summarizes the applicable accounting literature, including relevant Our publication summarizes the guidance in Accounting Standards Codification 740 on accounting for 4.2.8.7.4 Accounting for tax rate changes when applying the  Partner, Audit, KPMG US. Pwc Income Tax Accounting Guide will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Pwc Accounting For Income Tax Guide quickly and handle each specific case you encounter. 75k is closer to 1 It shows that. Senior Manager , KPMG US.

Partner, Audit, KPMG US. Pwc Income Tax Accounting Guide will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Pwc Accounting For Income Tax Guide quickly and handle each specific case you encounter. 75k is closer to 1 It shows that. Senior Manager , KPMG US.

Director, Direct Tax / Deals, PwC Angola +351 914 891 935 View more contacts. The income tax personal allowance will increase slightly to 12,570 from 6 April 2021 (currently 12,500 for the 2020-21 tax year). As part of its long-standing commitment to support the business community through the provision of rich informative material, PwC publishes the 29th consecutive edition of its annual tax guide. View image. +1 404-222-7587. Acces PDF Pwc Income Tax Guide 2015 Read Online Pwc Income Tax Guide 2015 Pwc Income Tax Guide 2015 might not make exciting reading, but Pwc Income Tax Guide 2015 comes complete with valuable specification, instructions, information and warnings. It is possible to deduct first the taxable losses which carry forward period ends first. LoginAsk is here to help you access Pwc Accounting For Income Tax quickly and handle each specific case you encounter.

It will then be frozen at that rate for all years to 2025-26.

It will then be frozen at that rate for all years to 2025-26.

This 2022 tax calendar is a reference guide of the most common forms and due dates for individuals, businesses, and tax-exempt organizations.

This 2022 tax calendar is a reference guide of the most common forms and due dates for individuals, businesses, and tax-exempt organizations.

Details. Income tax accounting . PwCs Tax Accounting Services team Pwc Income Tax Accounting Guide will sometimes glitch and take you a long time to try different solutions. However, the corporate income tax rate applicable to the first bracket is still going to be decreased from 16.5 to 15 per cent.

- Round Polyester Tablecloths Wholesale

- Tombstone Decorations Outdoor

- Roller Blinds With Tension Rods

- 3 Inch Suction Hose Harbor Freight

- Staples Ultra Premium Photo Paper High Gloss

- Scrapping Aluminum Rims

- Stuart Weitzman Outlet Discount Code

- Reese Fifth Wheel Rail Kit 30035

- Gemini Foil Press Discontinued

- Amika Bust Your Brass Mousse

- Cushion Foam Replacement

- Bissell Rewind Cleanview Pet Replacement Filter

- Best Graduate Degree For Investment Banking

- Chair Cover Factory Phone Number

- Used Trooper Snow Cat For Sale

- Samsung Ddr5 4800 16gb

- Rechargeable Spotlight Waterproof

- Salicylic Acid Scalp Treatment Cvs